Due Diligence Services by FOSTEC & Company

Over the past 25 years, the global digital economy and E-Commerce have grown rapidly. Thus, new successful business models were established, often by young companies. Such companies are agile and have an unconventional corporate culture. Their business models are not always comprehensible to outsiders and have different growth cycles. Sooner or later, both already successful and “newborn” businesses will be in the focus of their bigger competitors, private equity firms and venture capitalists. Moreover, digital ventures need capital to grow and to establish themselves in the “winner takes it all” market. Investors, in return, require an assurance that their money is properly and profitably invested. Both parties need a solid framework for an independent valuation of the intended transaction.

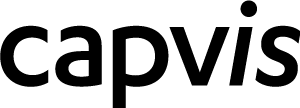

FOSTEC & Company offers 360-degree due diligence services to analyze all aspects of the business:

Figure 1: M&A buy-side support by acquisition of digital & E-Commerce targets

The service portfolio of due diligence services includes services of varying scope and focus. The service portfolio ranges from initial red flag reports to a full-scope commercial due diligence report, which can be used as a basis for financing discussions with banks.

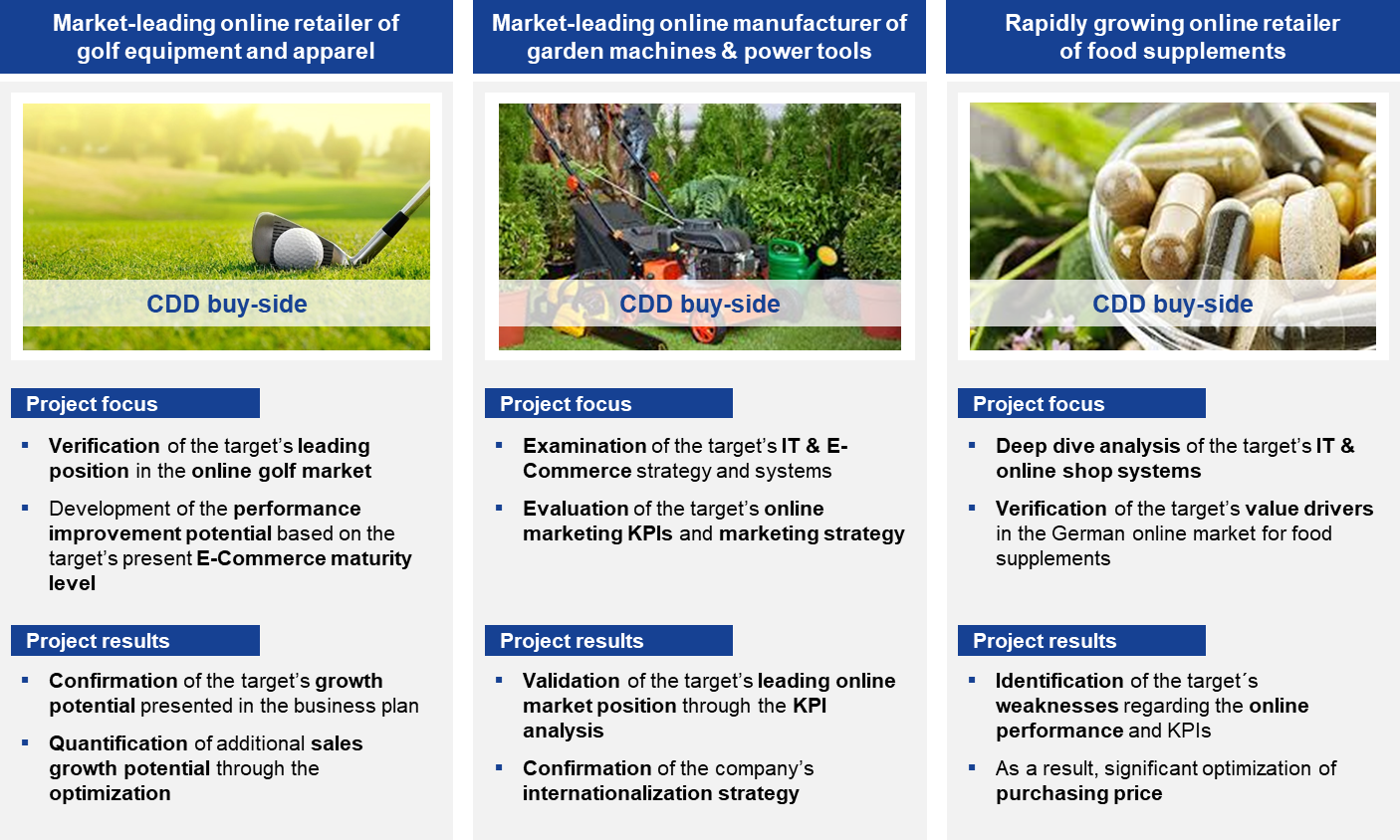

FOSTEC & Company has already carried out a variety of Commercial Due Diligence Projects.

Figure 2: Selection of previously carried out Commercial Due Diligence projects

Commercial Due Diligence (CDD)

FOSTEC & Company has in-depth knowledge of various relevant digitization and E-Commerce industries. The spectrum of knowledge ranges from software solutions for corporate digitization to classic E-Commerce topics and digital business models.

In the course of accompanying numerous transaction projects, FOSTEC & Company has gained experience with different types of investors and financial sponsors (PE, VC, family offices) and has valuable project know-how regarding investment sweet spots of different sizes, from specialized small cap funds to global large cap investors.

Figure 3: Due Diligence industry expertise of FOSTEC & Company

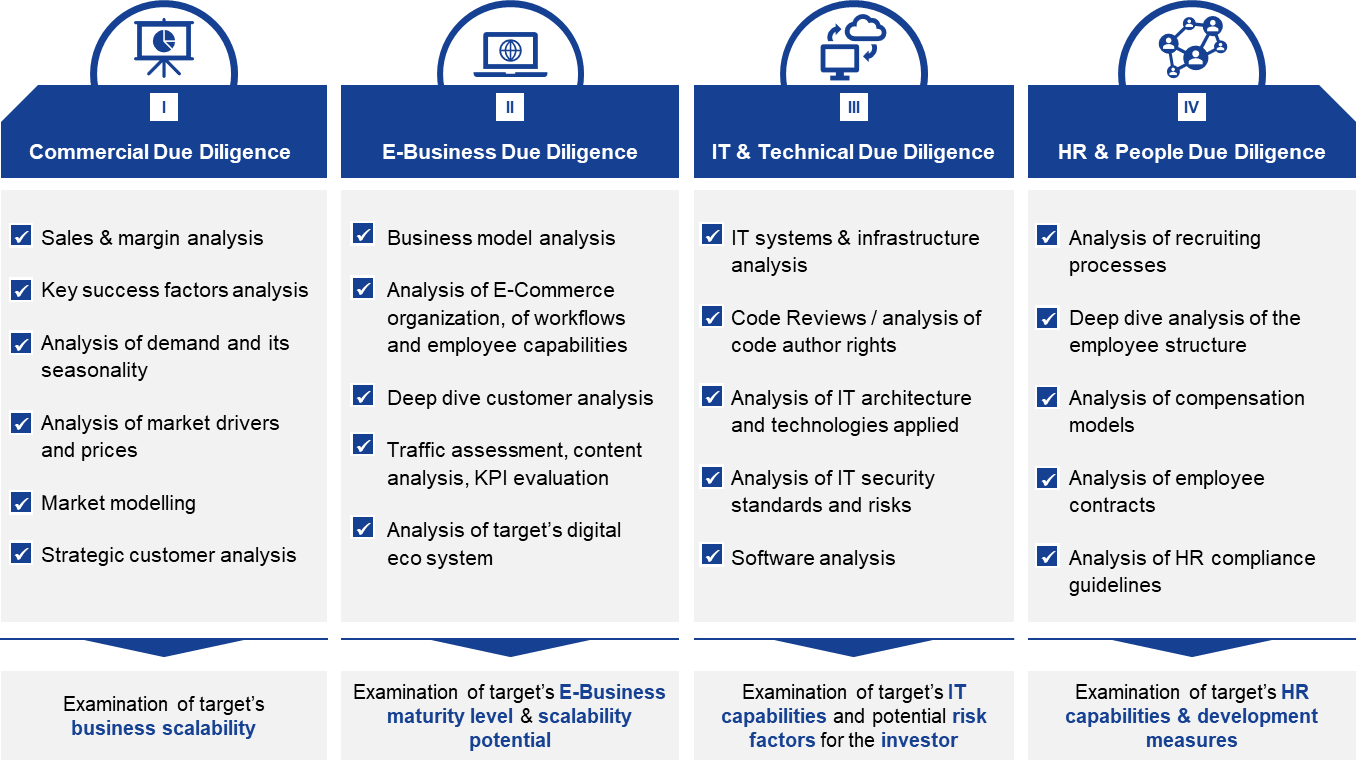

The execution of a Commercial Due Diligence follows a two-phase project approach. Phase I of Commercial Due Diligence (CDD) includes the development of a Red Flag Report, which aims to identify or rule out major risks related to the target company’s business model. In addition to the business model, the product range, sales funnels and order intake are evaluated, and sourcing and supply chain performance are assessed. Detailed evaluations are also made for customer performance by individual sales channels and product categories. The Red Flag phase also looks at the organizational structure and the competencies of key personnel.

Phase II of Commercial Due Diligence (CDD) focuses on the preparation of the Confirmatory Due Diligence Report, with the aim of providing deep insights into the company’s operations and business plan. FOSTEC Market Intelligence is used to quantify and evaluate the potential of the main sales channels. A central component is also the evaluation of the maturity level of the current and planned IT infrastructure and associated processes. The second phase of Commercial Due Diligence (CDD) is completed with the evaluation of the business plan in terms of revenue and EBITDA forecasts, including a logic check based on the results of the due diligence.

Figure 4: Commercial Due Diligence project approach

E-Business Due Diligence (EDD)

An E-Business Due Diligence (EDD) examines the scalability of E-Commerce companies and analyzes the key requirements and levers for sustainable future growth related to e-commerce activities. The seven-phase analysis process looks at both internal factors, which include organizational structure and IT systems, and external factors, the focus of which is a traffic assessment, customer structure and market.

While the first phase analyzes the business model, the E-Commerce organizational analysis identifies the core workflows, examines the efficiency and depth of the value creation processes, and derives optimization potential. The strategic customer analysis looks at quantitative and qualitative KPIs from new customer acquisition to churn rates and underlying causes, among other things. Traffic KPIs and development are of particular importance for achieving e-commerce goals, so traffic sources, structure and quality are identified, analyzed and evaluated. IT system analysis assesses the stability, scalability and agility of the IT infrastructure. The examination of the market and ecosystem is intended to provide information on market entry barriers, competitive intensity and growth forecasts, which at the same time serve as assumptions for validating information in the business plan.

Figure 5: E-Business Due Diligence project approach

IT & Technical Due Diligence (TDD)

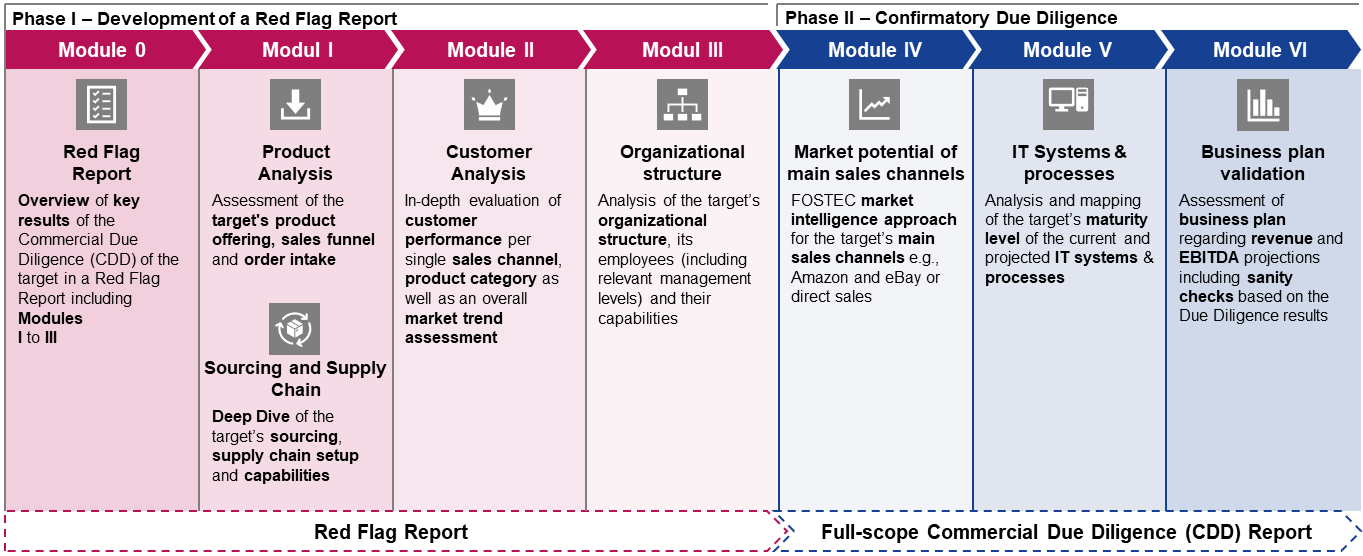

A Technical Due Diligence (TDD) identifies vulnerabilities in security & stability of IT products and the system architecture of the target company.

By evaluating the software solutions and infrastructure in use, state-of-the-art product standards as well as potentials and bottleneck-related scalability issues can be identified. Cybersecurity will continue to play an important role, highlighting the importance of technical due diligence (TDD) to verify required security standards and security controls established at the enterprise. Downtime Analysis (DTA) is a powerful tool for ensuring stability and gaining valuable insight into underlying software issues.

A Technical Due Diligence (TDD) analysis area is also the structure and documentation of an IT product’s code base. A clear and meaningful structure and disciplined documentation of the code base are of utmost importance for new team members and developers, as it helps them to immediately understand and be able to work on the code base.

Figure 6: Technical Due Diligence project approach

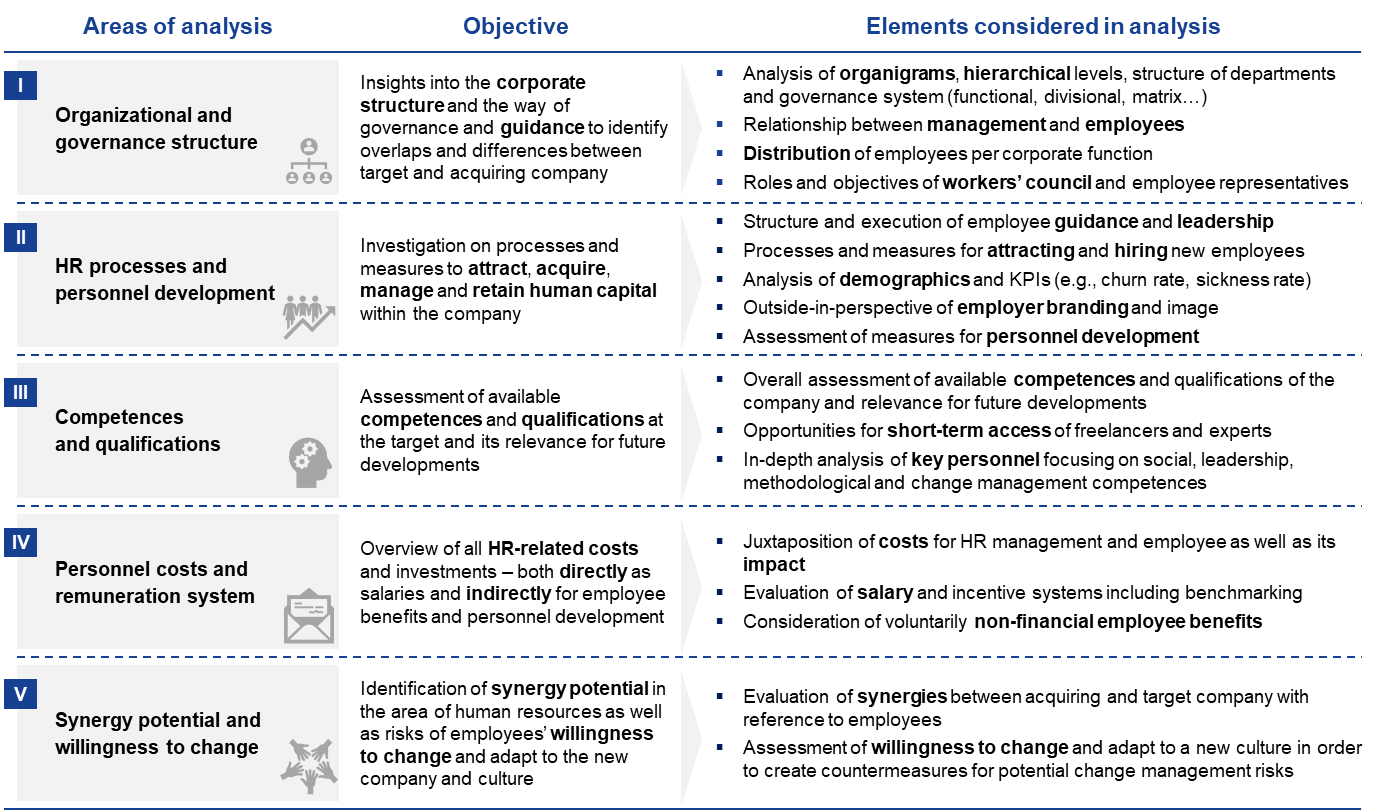

HR & People Due Diligence (HRDD)

HR & People Due Diligence (HRDD) comprises the analysis and identification of the potential and risks of the personnel of a target to be acquired. The five-step project approach is designed to provide insight into the company’s structure and how it is managed, as well as an assessment of all HR-related processes for attracting, hiring, managing and retaining talent within the company. The entire hiring process as well as employee retention initiatives and programs are analyzed.

A central component of a HR & People Due Diligence (HRDD) is also the assessment of all available competencies and qualifications and their significance for the future development of the company. This also involves the question of how quickly a company can access additional resources at short notice through participation or the establishment of networks. Personnel costs and compensation systems form a further area of analysis. Here, not only direct personnel costs and bonus payments are examined, but also non-financial benefits to all employees as well as personnel development measures and their effectiveness and efficiency. The identification of potential synergies in the HR area and the willingness to change on the part of the employees of the company to be acquired should provide information about potential risks in the acquisition.

Figure 7: HR & People Due Diligence project approach

Selected References

FOSTEC & Company’s industry expertise in diverse industries is also reflected in the extensive range of investors advised and targets analyzed.

Figure 8: Selected project references with PE focus

For example, FOSTEC & Company supported an investment bank from southern Germany in the acquisition of an online retailer in the sporting goods sector. The focus was on the confirmation of the growth potential defined by the seller as well as on the analysis of the internal optimization potential of the target. As a result, both the purchase price was significantly adjusted in favor of the buyer and the value enhancement potential for the bank was even more clearly defined. Some further selected project examples are listed below:

Figure 9: Selected project references in the field of Due Diligence

Our Due Diligence Services are considered a solid and reliable basis for strategic investment decisions in the field of digitalization and E-Commerce. The leading strategy consulting boutique FOSTEC & Company is at your disposal for all questions regarding business valuation and due diligence services. Our contact persons will be happy to help you and look forward to a first conversation with you.

Your contact for questions regarding Due Diligence Services

Markus Fost, MBA, is an expert in e-commerce, online business models and digital transformation, with broad experience in the fields of strategy, organisation, corporate finance and operational restructuring.

Learn moreMarkus Fost

Download our service portfolio & service approach of FOSTEC & Company Due Diligence services.

Please provide your name and e-mail address to receive an e-mail with the according PDF file free of charge.