Chinas E-Commerce market potential

With high growth rates and enormous trade turnover, China’s E-Commerce market looks very tempting for German manufacturers. A tripling of sales from approx. 315 billion USD in 2013 to over 1 trillion USD was recorded by the Chinese E-Commerce industry last year (ecommerceDB.com, 2020). Defying the overall economic slowdown, the E-Commerce turnover in China is expected to grow to over USD 1.5 trillion by the end of 2021. Due to this growth, China is one of the most sought-after E-Commerce markets in the world. This growth forecast becomes even more realistic when the Chinese government wants to further liberalise the domestic market and open it up to foreign providers. Thus, tariffs and other restrictions for foreign companies that want to sell products and services in China are to be gradually dismantled. Further incentives come from the Chinese population itself: The growing Chinese middle class with an above-average income already amounts to more than 300 million people. This segment of the population prefers Western products, which further increases the opportunities for foreign companies in the Chinese E-Commerce market.

However, many global brands fail to achieve commercial success in China’s E-Commerce. Among the well-known brands that have failed in China are Marks & Spencer, ASOS, Revlon and NewLook (Hamkai, 2018). The experience of these companies proves that to succeed in China, brands need to invest in developing a well-thought-out China strategy. The main goal is to differentiate from the increasing competition in China’s E-Commerce market and to creatively address the respective customer target group. In this approach, we show which strategy German brands should follow to exploit the growing potential of the Chinese E-Commerce market.

E-Commerce strategy framework

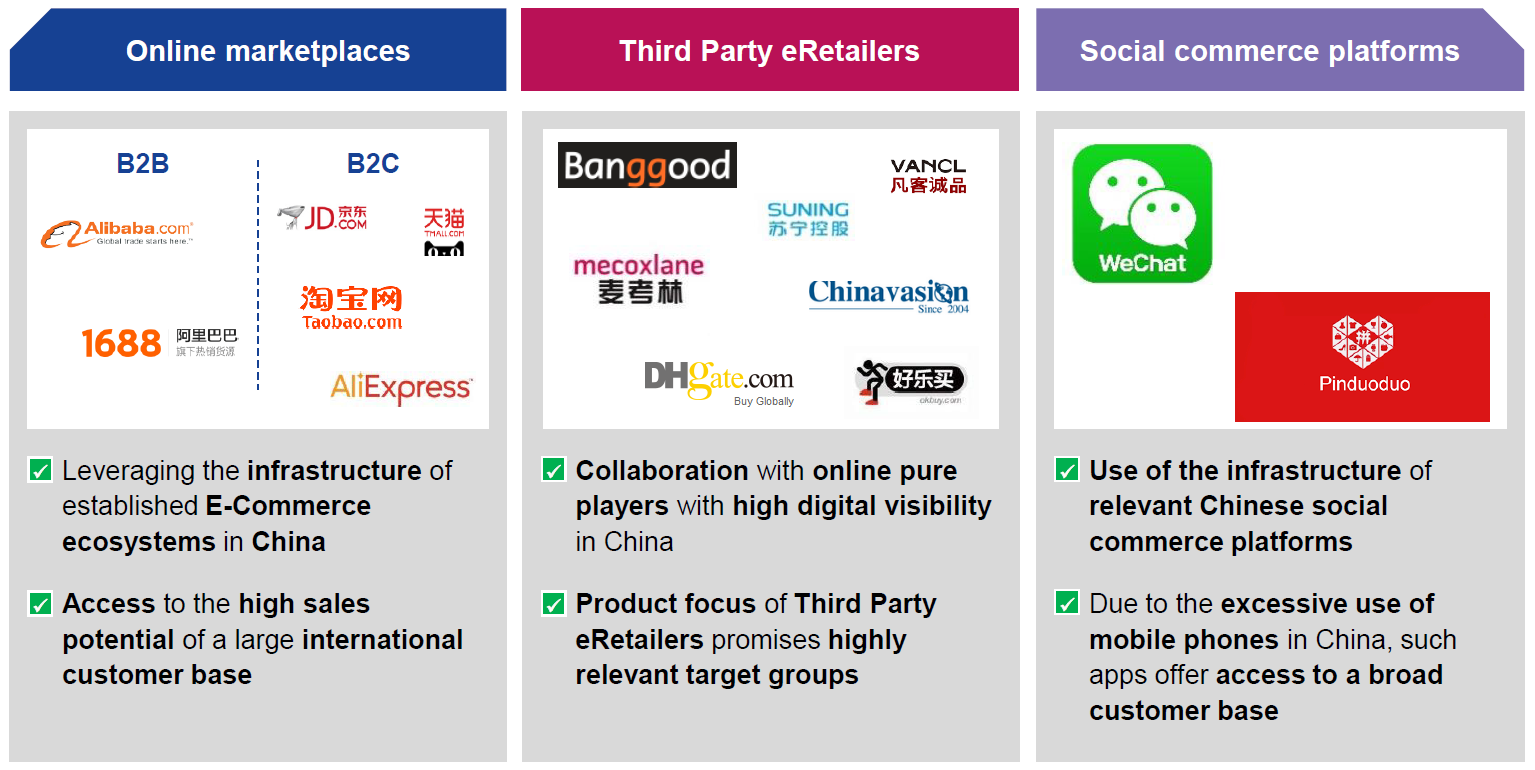

A successful E-Commerce strategy for China’s online market starts with defining the online sales channels available there. In the Chinese market, three online sales channels come to the fore: online marketplaces, Third Party e-retailers and social commerce platforms (see Figure 1).

Figure 1: Three pillars of the E-Commerce strategy for China

An own online shop, in contrast to the European E-Commerce environment, does not promise great sales potential for German manufacturers in China. The reason for this is that the Chinese E-Commerce industry is dominated by a few providers. For example, the combined market share of Tmall and JD.com (the two largest online marketplaces in China) was around 85% in Q4 2018. That is, most customers in China buy directly on these platforms, while smaller shops and platforms tend to be invisible compared to these big players on the internet. Furthermore, there are certain restrictions for foreign companies to open their own online shop.

Online marketplaces in China can be divided into B2B and B2C platforms. They are characterized above all by their high sales potential. While platforms such as Alibaba.com (B2B) or AliExpress (B2C) are globally active, there are well-known online marketplaces that are specifically tailored to the Chinese market (e.g., Taobao.com, B2C).

The second pillar of the E-Commerce strategy is formed by Chinese Third Party eRetailers. These offer high visibility in their product ranges and thus address relevant target groups within certain product categories across all sectors.

The third pillar is a sales channel that is rather untypical in Europe, the so-called “social commerce”. The world-famous pioneer of this sales model is the app WeChat. In addition to typical social media functions, it also offers a wide range of commercial functions, from its own payment system to a wide range of marketing activities and its own shopping platform. Due to the strong mobile commerce affinity of the Chinese population, apps like WeChat (over 1 billion users per month) offer a broad customer base.

Online marketplace strategy

There are six relevant online marketplaces in China, divided into two B2B and four B2C platforms. To develop an effective strategy for these marketplaces, seven steps are provided (see Figure 2).

Figure 2: Seven steps to a business plan-based online marketplace strategy

Step I: Prioritisation of potential partners

In the first step, the identified online platforms are prioritised based on predefined selection criteria. The aim is to prioritise those online platforms that promise the highest sales potential for a particular company.

Step II: Potential analysis

In the next step, the market potential of the selected marketplaces is determined and quantified on the basis of FOSTEC Market Intelligence in order to create a basis for the choice of business model.

Step III: Business model analysis

The options for choosing a business model depend on the platform selected in each case. FOSTEC & Company offers the analysis and evaluation of existing platform-specific business models in order to be able to make a recommendation for the right business model, taking into account the opportunities and risks for the brand-specific use case.

Step IV: Logistics strategy

In this step, it is important to develop a logistics concept to supply the Chinese market and at the same time meet the needs of the platform. It should be taken into account that not all online platforms in China offer independent fulfilment.

Schritt V: Online marketing strategy

In this step, it is important to develop a logistics concept to supply the Chinese market and at the same time meet the needs of the platform. It should be taken into account that not all online platforms in China offer independent fulfilment.

Step VI: E-Commerce organisation

The focus here is on setting up a dedicated E-Commerce organisation. This requires a clear distribution of roles, tasks and responsibilities and must be individually tailored to the Chinese sales market.

Step VII: Business plan-based online marketplace strategy

Building on steps I-VI, the last step is to develop a detailed business plan for the entire strategy in the “online marketplaces” channel. This requires a comprehensive consideration of all costs and benefits that arise in sales via Chinese online marketplaces in order to assess the profitability of the entire strategy.

Third Party eRetailer strategy

In addition to the large online marketplaces in China, there are a large number of online retailers. Although these companies are significantly smaller than the large online marketplaces, they often focus on specific niche markets, which means that Chinese customers can be addressed in a targeted manner. Therefore, it is important to develop a sub-strategy for Third Party eRetailers within the framework of the present E-Commerce strategy for China. A corresponding strategy framework can be found in Figure 3.

Figure 3: Seven steps to a business plan supported Third Party eRetailer strategy

Step I: Pre-selection of potential partners

The second pillar of the E-Commerce strategy also starts with a pre-selection of partners. Due to the similarities between the business models of Chinese online marketplaces and Third Party eRetailers, the strategic procedures for both channels are basically similar. However, it is important to consider that the number of potential partners (Third Party eRetailers) is much larger than the number of potential online marketplaces. Thus, step I in this pillar is much more extensive. The selection and evaluation of the online partners is carried out with the help of a longlist-shortlist procedure in which a narrower selection of potential E-Commerce partners (shortlist) is finally evaluated and prioritised with a strategic scoring model.

Step II: Market potential analysis

Based on the scoring model for the evaluation of the pre-selected online retailers and on the market intelligence data of FOSTEC & Company, a market potential analysis for Third Party eRetailers in China is conducted.

Step III: Business model analysis

In the next step, the various business models, which differ depending on the partner, are analysed. The aim is to evaluate the opportunities and risks that arise from the respective business models and based on this evaluation, to identify the optimal business model for the customer.

Step IV: Logistics strategy

In the following, a logistics strategy is defined, which should be as closely interlinked as possible with the strategy from Pillar I (online marketplaces) in order to realise synergies within the overall E-Commerce strategy for China. The strategy must ensure the secure and punctual supply of Chinese Third Party eRetailers.

Step V: Online marketing strategy

The online marketing mix, which was previously tailored specifically to China’s online marketplaces, is also expanded accordingly to reach potential customers of the Third Party eRetailers.

Step VI: E-Commerce organisation

Here, the existing E-Commerce organisation for the Chinese market, which was already defined and established in Pillar I (online marketplaces), can be built upon.

Step VII: Business plan (bottom line) for Third Party eRetailers

Finally, a bottom-line business plan is prepared for the segment of Third Party eRetailers, which includes all existing costs and benefits of the cooperation with selected partners. This allows for an accurate planning of future investments in the Chinese E-Commerce market for German manufacturers.

Download

Please provide your name and e-mail address to receive an e-mail with the according PDF file free of charge.

Social commerce strategy

The last pillar, which is rather untypical outside of Asia, is made up of social commerce channels. FOSTEC & Company offers a dedicated strategy for this pillar, tailored to the best-known representative of these channels, the WeChat app with over one billion monthly users worldwide (see Figure 4).

Figure 4: Seven steps to a business plan-based social commerce strategy

A selection of potential social commerce channels is not necessary in this case, as apart from WeChat there are no other applications worth seeing for European brand manufacturers in this segment.

Step I: Potential analysis

The approach starts with the determination of the revenue potential of WeChat based on an analysis of the market and the input of expert know-how.

Step II: Business model analysis

WeChat offers various possibilities to market its own products via its platform, which is why a precise analysis of the possible business models is necessary in order to be able to evaluate the opportunities and risks. At the same time, it is necessary to define a benefit strategy for WeChat as an E-Commerce interface.

Step III: Logistics strategy

Since WeChat does not offer any fulfilment or shipping options, the existing logistics strategy from the first two pillars should be adapted accordingly in order to be able to cope with the order load for small orders in the B2C sector, for example.

Step IV: Online marketing strategy // CRM Strategy

The online marketing strategy should also be expanded, since WeChat itself offers a large number of online marketing possibilities with which the marketing mix can be expanded and channel-specific oriented. However, in addition to a large selection of marketing tools, WeChat also offers some functions of a CRM system, which is why a tailored CRM strategy is essential for success on the platform. It is also important to recognise the benefits of so-called “mini-apps” (apps that are not downloaded via a store but are available within the WeChat app without media discontinuity) and to use them sensibly within the framework of CRM.

Step V: E-Commerce organisation

In this pillar, too, it is not necessary to set up an independent E-Commerce organisation; instead, it is possible to build on the existing organisation. Nevertheless, dedicated professionals for business management via WeChat and its mini-apps should be provided in the overall E-Commerce organisation for China.

Step VI: Business plan-based social commerce strategy

Finally, a business plan considering all relevant variables for the social commerce platform WeChat should be developed.

Based on the three channel-specific business plans, a precise overview of the opportunities and risks of entering the Chinese market can be gained. Furthermore, FOSTEC provides a roadmap for the correct coordination of all important functions (marketing, personnel, etc.) to achieve maximum profitability (Figure 5).

Figure 5: Overview of the E-Commerce strategy for the Chinese market

FOSTEC & Company’s strategy framework is considered a confident basis for decision-making when investing in China’s E-Commerce market. FOSTEC & Company, as an expert in E-Commerce strategy development, is happy to assist you in developing your own China E-Commerce strategy. In close consultation with you, we analyze your entire sales potential and derive recommendations for action for your company’s strategy in China. We are happy to help you with any concerns and look forward to an initial discussion with you.