Overview – E-Commerce Strategies for Brand Manufacturers

The right e-commerce strategy contributes significantly to the success of a business today. But what is the best way of going about creating this strategy? “Businesses need to consider adding ecommerce to their repertoire if they haven’t already or risk being left behind.” (Forbes 2018). The beginnings of e-commerce go back to the 1970s and obviously a lot has happened since then. Our everyday life cannot be imagined now without what began with a scarcely existing business model and is now one of the most important pillars of the success of many businesses. Many business models are even based exclusively on that and the end of the success story is far from being in sight: new technologies like virtual reality, augmented reality, biometrics or artificial intelligence continue to help e-commerce to almost unrestricted growth as they make the purchasing experience more convenient and quicker every day and make the customer experience more pleasant. The Next Big Thing in e-commerce? Experience management in the digital world. As so often, it is Amazon at the forefront of this. The Seattle company, currently leader of the digital pioneers, is primarily involved in gaining data and thus being able to offer more and better personalised experiences. There are plenty of initiatives for this on the part of Amazon: the smart voice assistant Alexa, which has turned marketing upside down and meets the wishes of customers any time anywhere, Amazon’s own delivery service Amazon Fresh, first forays into stationary trade or into the health system. What currently primarily affects the B2C is slowly but surely spilling into the B2B business as well and is driving turnover generated through e-commerce ever higher. According to the Bundesverband E-Commerce und Versandhandel Deutschland e.V. (German Association of E-commerce and Mail-Order Trade), the gross turnover of goods in the German B2C e-commerce rose to 58 billion Euro in 2017 (+ 10.9% compared with 2016), one Euro in eight is thus already earned online in retail. The B2B e-commerce sector offers even greater growth potential. Even if the gross turnover here in 2017 was significantly lower at 35 billion Euro, this sector offers almost unlimited growth potential which will quickly unfold in coming years. A sales volume of 46 billion Euro is forecast for Germany as soon as 2019. Exporting companies are even looking at a world-wide B2B e-commerce market volume of 5.83 billion Euro by 2020 that is thus predicted to be double the size of the B2C market (forecast 2.78 billion Euro).

E-Commerce – Opportunities and Challenges for Businesses

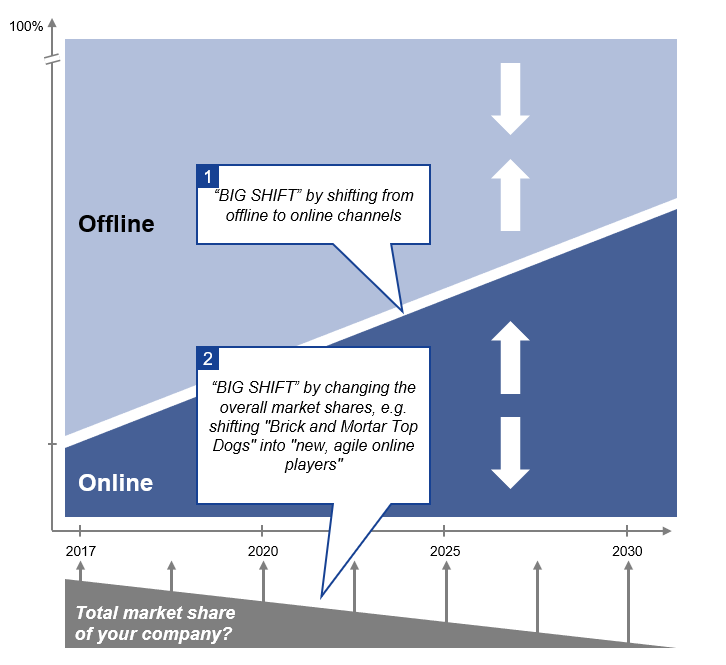

Fast and flexible. These are adjectives that probably most accurately describe our zeitgeist. The ideal competitor, the ideal mobile phone contracts and the ideal trade businesses are fast, flexible and transparent. Our everyday lives and with it our wishes and demands are changing rapidly. Only those who manage to respond quickly to the most recent developments, or, even better, to drive them forward themselves, will win the race to the customer. One of these developments for example is the attempt to enhance conventional e-commerce platforms with voice-commerce systems or in some cases, to completely replace them with these. This sounds very simple at the moment, but it isn’t. It not just the interface that is changing. In many respects, Alexa follows different rules, primarily her own. She is re-defining customer access, existing ordering processes and the Customer Journey and traders who wish to sell their products via Amazon will have to bow to these rules. There can only be one answer to these developments: “if you can’t beat them, join them”. This is new-found mentality of stationary trade which is coming under huge pressure through the upturn in e-commerce and is constantly losing market share to e-commerce. In view of the fact that more and more Brick and Mortar top dogs are reporting insolvencies and fighting for survival, stationary trade has taken the only logical decision and introduced a quick expansion without the necessity of a physical presence. As a result of that, manufacturers must follow aggressive e-commerce strategies to compensate for the decreasing stationary trade sales, which however has the consequence that the trade threatens the manufacturers with being dumped. These so-called channel conflicts lead, amongst other things, to many production companies only using the e-commerce channel passively or not at all up to now. Along with the untapped opportunities of an increasing shift from offline to online channels (“BIG SHIFT“), this process also hides the danger of a shift of market shares associated with the shift in channels. Added to that is that traditional market producers in the online-channel generally do not achieve the same market share in the online channel that they have in stationary trade, which results from the fact that there are many private label brands in the online channel, for which the market entry barriers to stationary trade would be too great. It is also not only the market shares amongst producers that are changing, market share from bricks and mortar traders to new, agile online-trading models is too. The drop from individual stages of the value creation chain associated with the surge of B2C and B2B online market places amplifies this situation and leads to even greater substantial shifts in market share, so brand producers are losing out to competitors who are following a better e-commerce strategy, and who are gaining market share in the online area.

Figure 1: Representation of the channel shift der from offline to online

Producing companies are faced with various challenges in respect of their e-commerce strategy for different reasons:

- E-commerce sales channels in the platform economy bring with them lower cost structures and thus lead to cheaper sales prices. If there are aggressively prices sales by trade partners on market places and online shops, this leads to price erosions with brand producers and increasing channel conflicts with stationary trade.

- The price transparency that comes through online trade, with non-differentiated condition models and uncontrolled channel strategies, also leads to unpredictable brand and image confusion.

To exploit the opportunities that the e-commerce channel offers despite these risks requires a well thought-through strategy. This must anticipate the risks and be able to use the market development profitably to ensure a sustainable competitive advantage through a considered approach.

Our Solution – Your Added Value

Against this background, the decision to develop your own e-commerce strategy or adjust and optimise an already existing one to the changing market conditions is necessary. Through years of experience in the development of e-commerce strategies in the B2C and B2B area, FOSTEC & Company can offer you support and solutions for achieving your full market potential. The following chapters give you information about our solution approaches.

FOSTEC E-Commerce Strategies

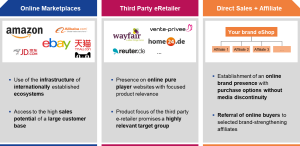

E-commerce can basically be divided into four pillars of Online Market-places, Third Party e-Retailers, Direct Sale + Affiliate and Procurement Platforms. Whilst the first three pillars form a fixed component of a B2C e-commerce strategy, the B2B e-commerce strategy is enhanced by Procurement Platforms. Each of these columns has individual properties having different strategic importance to a manufacturer, supplier etc., depending on various factors (e.g. product, target group, realisation competence, etc).

Figure 2: E-Commerce components in B2B

Figure 3: E-Commerce components in B2C

The FOSTEC e-commerce strategy approach of considering all four pillars allows identification of blind spots and potentials, derivation and prioritisation of strategic fields of action and the determination of a concrete implementation plan up to the construction of an independent e-commerce organisation.

Online-Market-place Strategy

Typically, a B2B and B2C online market place strategy can be created in six steps, as you can see in figure 4:

Figure 4: B2C- and B2B-Online-Marketplace-Strategy on the example Amazon

- The first step encompasses an analysis of market potential, in which sales potential is established on the basis id data-driven market intelligence with actual transaction data. Only if sufficient market potential can be identified in the first step on a “numbers – data-facts” basis can further work on a suitable strategy be usefully considered.

- Building on that, an analysis and evaluation of the Amazon business model of vendor and marketplace follows under consideration of opportunities and risks for the brand-specific application case.

- Then the appropriate Marketing Mix strategy (focus here is the 5Ps) must be defined,

- Negotiate with selected market-place prices and conditions,

- and specify a dedicated organisation

- with suitable control logic.

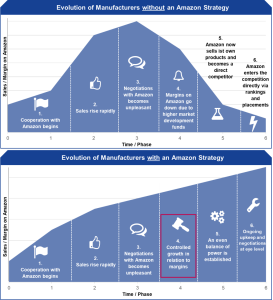

Sustained success can be achieved if the strategic core elements are worked out systematically, as our long experience shows that the approach has a decisive effect on the success and the relationship with, for example Amazon. These first six steps of the online market-place strategy feed into a business plan– which becomes more detailed over the course of the project. This comprehensively considers all important costs and benefits of distribution across selected online market places. Figure 5 illustrates the process with and without strategy which is typical from our experience:

Figure 5: Evolution of revenues and margins when working with Amazon

Third Party eRetailer Strategy

Third Party eRetailer or Online Pure Player means suppliers who (generally) carry out their transactions exclusively online. Frequently, these suppliers have a very clear focus on certain product categories. Accordingly, listing on Third Party e-Retailers promises producers and other suppliers access to a highly relevant target group. However, in Germany alone there are, according to various estimates, about 616,000 online shops, since the market entry barriers for opening an online shop are low. If, though, the distribution of generated sales is taken into consideration, there is a strong market concentration on a small number of large players by contrast to the fragmented picture of the number of online shops. As can be seen in Figure1, around 0.1 % of the online shops generate a total of 86% of total online sales.

When creating a third party eRetailer strategy, it is therefore essential to analyze for whom onboarding and the associated onboarding expenses are really worthwhile. Such a third party eRetailer strategy typically consists of the following core elements:

Figure 6: B2C/B2B Third-Party-eRetailer-Strategy

- In the first step, a selection and evaluation of potential Third-Party e-Retailers is made using specific criteria.

- Then the definition of a price strategy with a performance orientated conditions model which will harmonise with existing channels can be tackled. The initial evaluation of potential Third-Party eRetailers is also enriched by price monitoring. This checks to what extent the suppliers are following a low-price strategy and are thus contributing to the price erosion which can cause lasting damage to a brand. The result is that only eRetailers who are contributing to sustainable brand formation, and not distributing according to the criteria of brand producers, are selected on a short list.

- There then follows a determination of the potential of Third Party eRetailer channel based on the previous short list selection.

- Along with the topline data, it is also necessary–as input for the Business Case too– to define the set-up of an experienced Key Account Management (KAM) team with digital expertise and to specify the construction of the cooperative online marketing.

- The KAM team later monitors the cooperative online marketing campaigns, i.e. coordinated or synchronised marketing activities across all suppliers to strengthen the digital visibility of a brand.

Our experience has shown that especially the systematic selection of Third Party eRetailers and their subsequent control have an effect on how successfully and sustainably this e-commerce channel actually develops.

B2B Procurement Platform Strategy

Procurement platforms bundle the procurement activities of a business in an electronic system giving access at one central point to the goods and services from suppliers. Offers for goods and services in demand can thereby be submitted automatically. Purchasers then come with their requirement to a broad market of the most selected suppliers to meet their own requirements efficiently and cost effectively. The core elements of a B2B Procurement Platform Strategy largely resemble those of the Third Party eRetailer in respect of the implementation of onboarding.

Figure 7: B2B Procurement-Platform-Strategy

Direct Sales and Affiliates Strategy

Direct Sales means the direct sales via an in-house e-shop. Sales can basically be one of three varieties.

- Online Direct Sales: This is where a manufacturer sells direct to the end consumer via an online shop.

- Online forwarding to affiliates: In this version, purchasers can be connected from the manufacturer’s online shop to partners– so-called affiliates. Affiliates are generally selected Third Party eRetailers. Third Party eRetailer or Online Pure Player means suppliers who conduct their business (usually) completely online.

- Of course, a hybrid of direct sales and connection to affiliates is also possible.

Along with these basic types there are also other variants, in which, for example, a connection to stationary trade (like through on-line searches of offline traders) is established. Apart from that, there are various technological demands that have to be clarified depending on the aim of the e-commerce activity (content management systems vs. shop systems). Overall, in the B2C environment, it is primarily brand manufacturers in branches with a higher level of online maturity (e.g. travel or consumer electronics) that show a tendency towards the first variant, i.e. online direct sales via the manufacturer’s own e-shop. Regardless of the actual configuration, the aim is to offer potential end consumers the possibility of reaching a sales decision seamlessly– whether that is direct from the manufacturer or a recommended partner. Seamless integration like this and a strategic but also systematic affiliate selection must be defined precisely in the context of a dedicated Direct Sales and Affiliates strategy.

Figure 8: B2C/B2B Direct Sales- & Affiliates-Strategy

- In the first step, the positioning of the online brand presence is undertaken in which the degree of verticalization is defined, i.e., to what extent products are only to be shown in the context of a showroom or whether the development should reach as far as direct sales. Depending on that, there is also a decision regarding a Content Management System (CMS) integration in respect of the implementation of a comprehensive e-commerce framework.

- Following from that, the Affiliate Strategy and Services must be defined, i.e. a decision must be reached regarding the trader integration (partial or complete) and specifying the services associated with that.

- After a decisive direction has been chosen after the first two steps, the establishment of the Affiliate Partner concept with conditions model, partner selection and partner agreements and legal checks follow as important constituent parts.

- Then a proof of concept is carried out in which includes contract negotiations with selected potential trading partners. These are then monitored in a KPI report.

- After a successful test run, the comprehensive technical implementation and onboarding of further affiliates follows.

In particular, the systematic selection of affiliates and their subsequent control affects how successfully and sustainably this e-commerce channel actually develops.

Summary

Sustainable success in the market requires a professional e-commerce strategy individually tailored to the company, for which the core elements of the various pillars of e-commerce must be systematically developed and evaluated in consideration of the requirements of your own company and the competitive environment. Our long years of experience shows that the approach to this has a crucial influence on the success or failure of the undertaking. Systematic analyses in the run-up and an efficient approach are the key and more successful in the long term than actions that are though out and implemented “quick and dirty”. The results of the individual analyses and decisions then feed into a business plan, which becomes more detailed over the course of the project and comprehensively weighs up all costs and benefits of the analysis results for your business. Let us use our substantial experience and our expertise to support you and rely on the results:

- We will identify the improvement potential of your business.

- We will develop scenarios for the ideal e-commerce solution for your customers.

- We will support you in adjusting your internal and external processes to your new e-commerce strategy.

- Your strategy is always at the cutting edge thanks to our expertise.

- We will work closely together with you and you will always have an influence on the project progress.

We will be happy to support you with the development of your individual strategy. Just send your enquiry to us at info@fostec.com!

Download

Download our overview of e-commerce strategies here:

Please provide your name and e-mail address to receive an e-mail with the according PDF file free of charge.