Successfully reach end customers with a direct-to-consumer strategy

More and more manufacturers are taking the initiative to offer their products directly to end customers. Consumer behavior shaped by digital and social media has strongly promoted the development of direct-to-consumer (D2C) and was even accelerated by the Corona pandemic. Due to government-ordered store closures in the lockdown and the associated elimination of stationary distribution channels, manufacturers were forced to immediately rethink their previous distribution strategies and establish new distribution channels with direct customer contact in a short period of time.

Direct-to-consumer can be implemented in different ways by manufacturers. Online marketplaces and platforms such as Amazon and eBay offer product listings and direct sales to end customers. Alternatively, manufacturers can operate their own online shop or use social media platforms such as Instagram to offer products in the context of Social Commerce. Numerous start-ups pursue a pure direct-to-consumer approach and can demonstrate considerable growth, making them attractive acquisition targets.

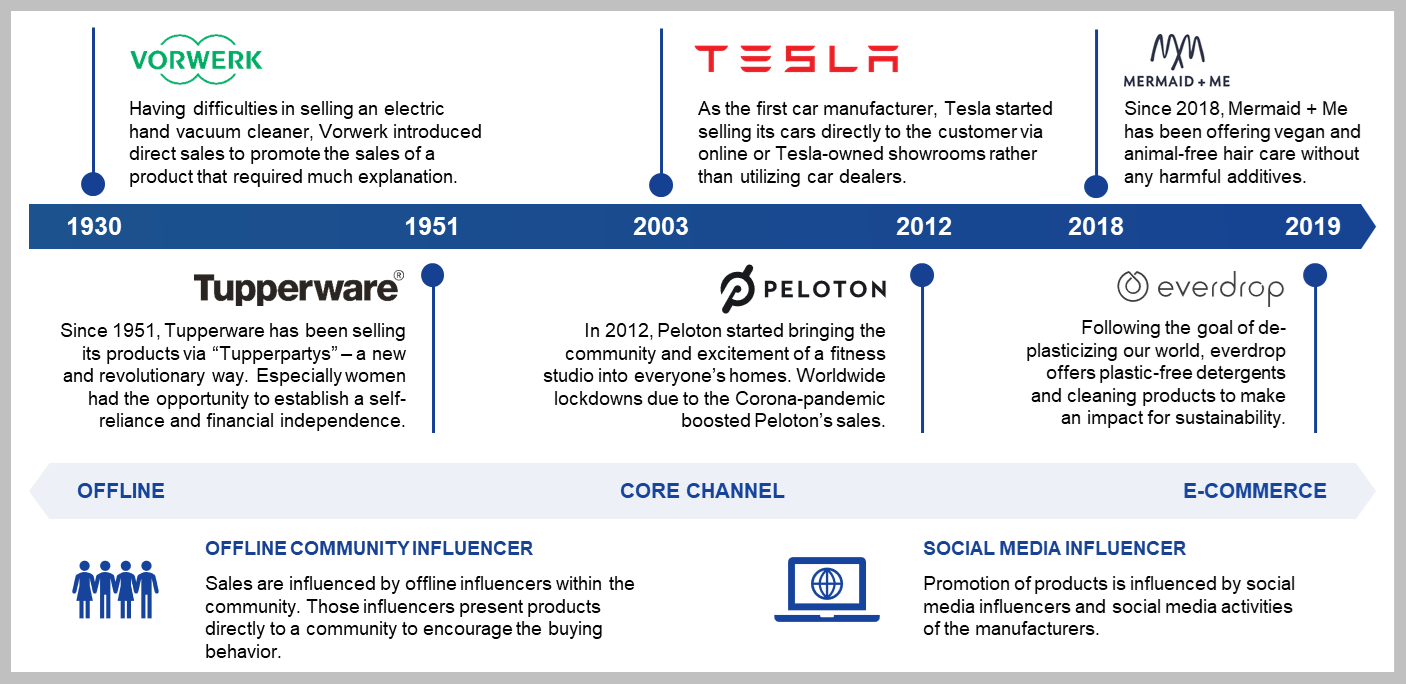

Despite its current popularity, direct-to-consumer is not a recent phenomenon but has been around for decades. The business model of brands like Vorwerk and Tupperware is entirely based on pure direct-to-consumer sales. What is new, however, is that the E-Commerce sales channel is taking precedence and there is a shift from offline advertisers to social media influencers. The brands Peloton, Tesla, Mermaid + Me or everdrop are just a few examples that handle their sales exclusively online and have established a direct connection to the customer.

Figure 1: On the timelessness of D2C Brands

Many direct-to-consumer brands have emerged from the vision of the founders to create a more sustainable product and thus achieve more fairness and safety for people and the environment. However, direct-to-consumer brands do not only emerge from start-ups; established manufacturers are also considering building-up a D2C brand or acquiring existing ones. The aim is to bypass the multi-level distribution system with distributors and establish direct contact with end customers.

The consumer goods manufacturer Henkel has recognized the attractiveness of D2C brands and secured a majority stake in the Berlin company Invincible Brands Holding in 2020, which includes the fast-growing D2C brands from the premium beauty segment HelloBody, Banana Beauty and Mermaid + Me. With more than 1.5 million active customers, Henkel wants to strengthen its digital positioning and expand direct customer contact. At the end of 2020, the food company Nestlé also acquired the British cooking box start-up Mindful Chef and the US ready-meals start-up freshly – both pure D2C brands with a large customer base.

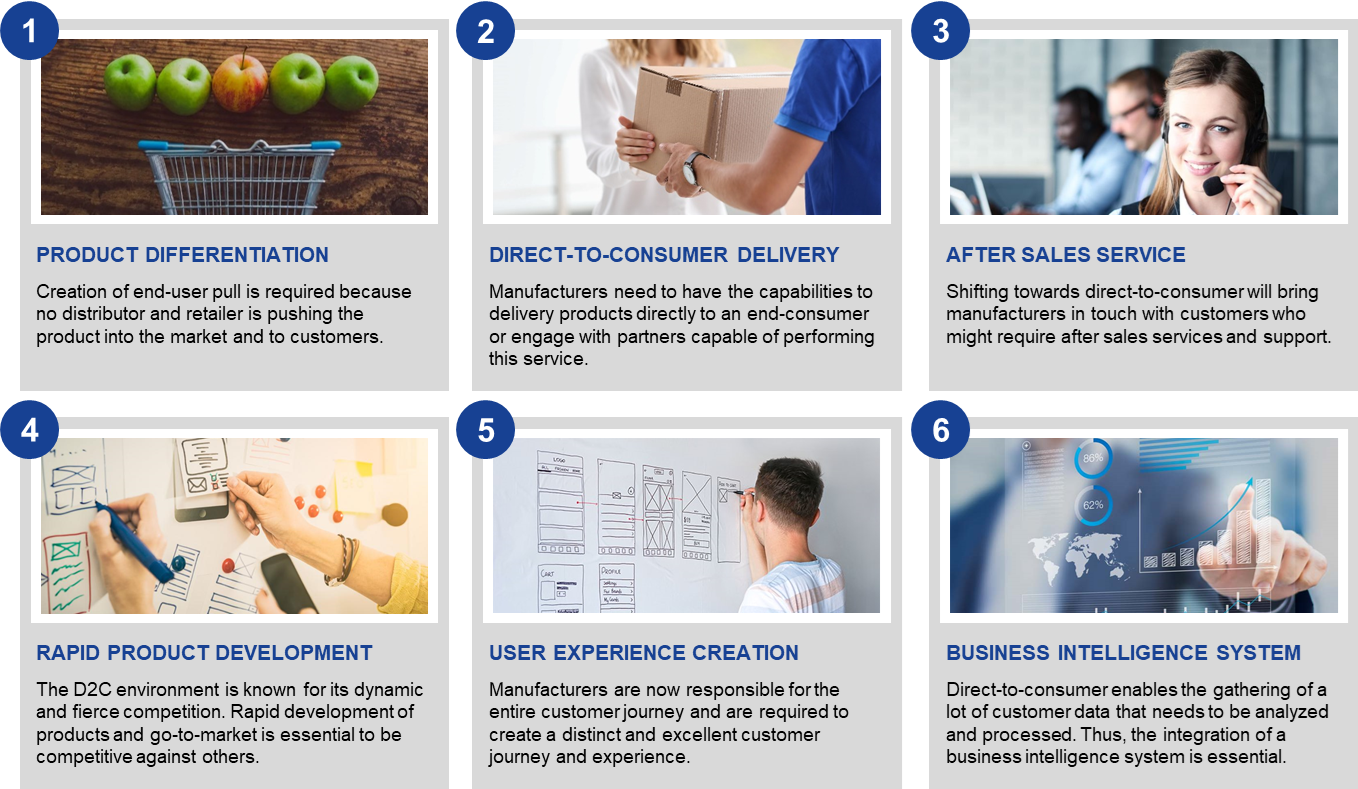

Regardless of the specific goals pursued by building or acquiring a D2C brand, the following requirements must be met for a successful D2C strategy:

- Product differentiation: Products must strongly differentiate themselves from competitors and independently generate end-user pull, as there are no distributors or retailers involved to do this.

- Direct-to-consumer delivery: Manufacturers must be able to deliver products directly to the end consumer or work with partners who can provide this service.

- After sales service: The shift towards direct-to-consumer puts manufacturers in touch with customers who may need after sales services.

- Rapid product development: The D2C environment is known for its dynamic and fierce competition. Rapid product development and go-to-market is essential to be competitive with other vendors.

- Creating user experience: Manufacturers are now responsible for the entire customer journey and must create a clear and excellent customer journey and customer experience.

- Business intelligence system: Direct-to-consumer collects a lot of customer data that needs to be analyzed and processed. Therefore, the integration of a business intelligence system is essential.

Figure 2: Prerequisites for establishing a D2C strategy

Awareness and engagement with the topic of D2C strategy began at the latest with the acquisitions of Flaschenpost.de by Dr. Oetker and Invincible Brands by Henkel. For sustainable success in establishing a direct-to-consumer brand, a systematic strategy is required that should answer the following questions:

- Market potential & trend analysis: What is the sales potential of the brand and products to be established? Which trends and which zeitgeist exist so that the brand and the products can be aligned with them?

- Environment analysis & USP definition: Which competitors are active and how are they positioned in E-Commerce? What distinguishes the competitors and what are the unique selling points of the own brand or the own products?

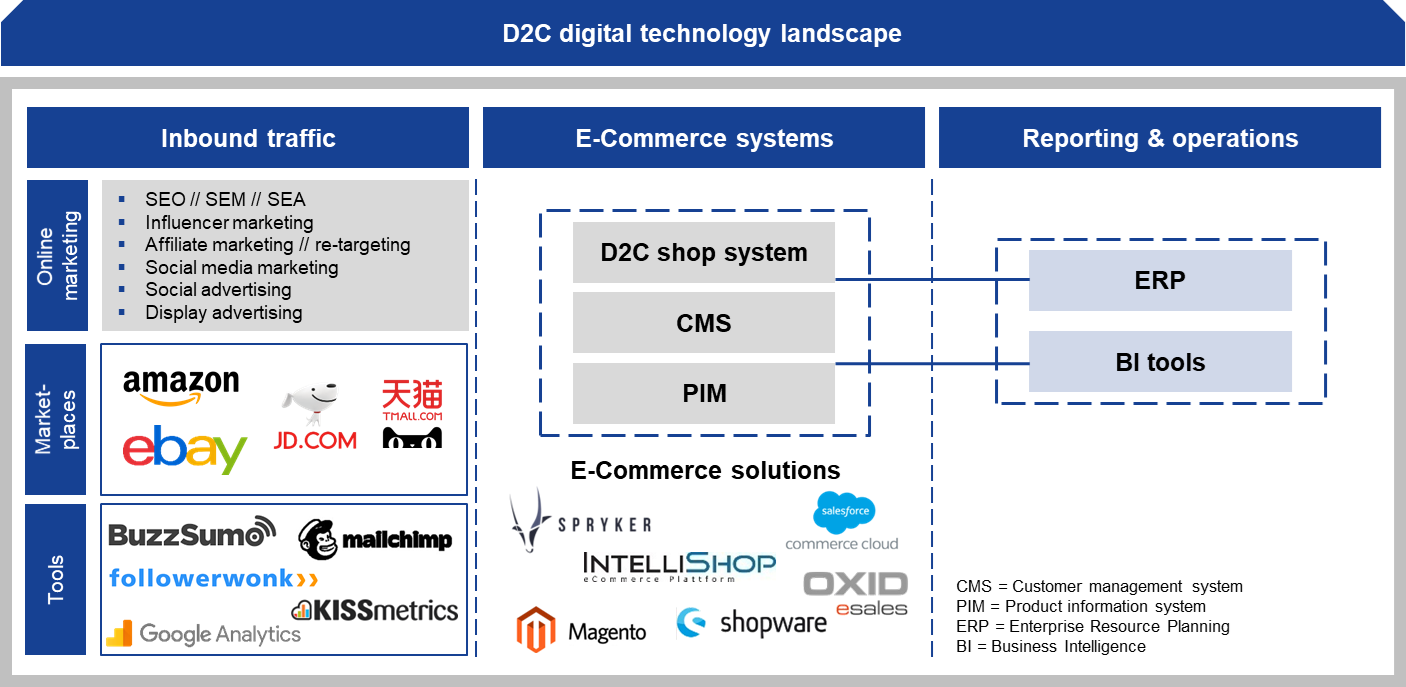

- Definition of a technology landscape: Which IT systems are required for the successful implementation of a D2C strategy and which components already exist to create synergies?

- Develop a marketing strategy: Which online marketing channels should be selected to achieve the highest possible return on investment?

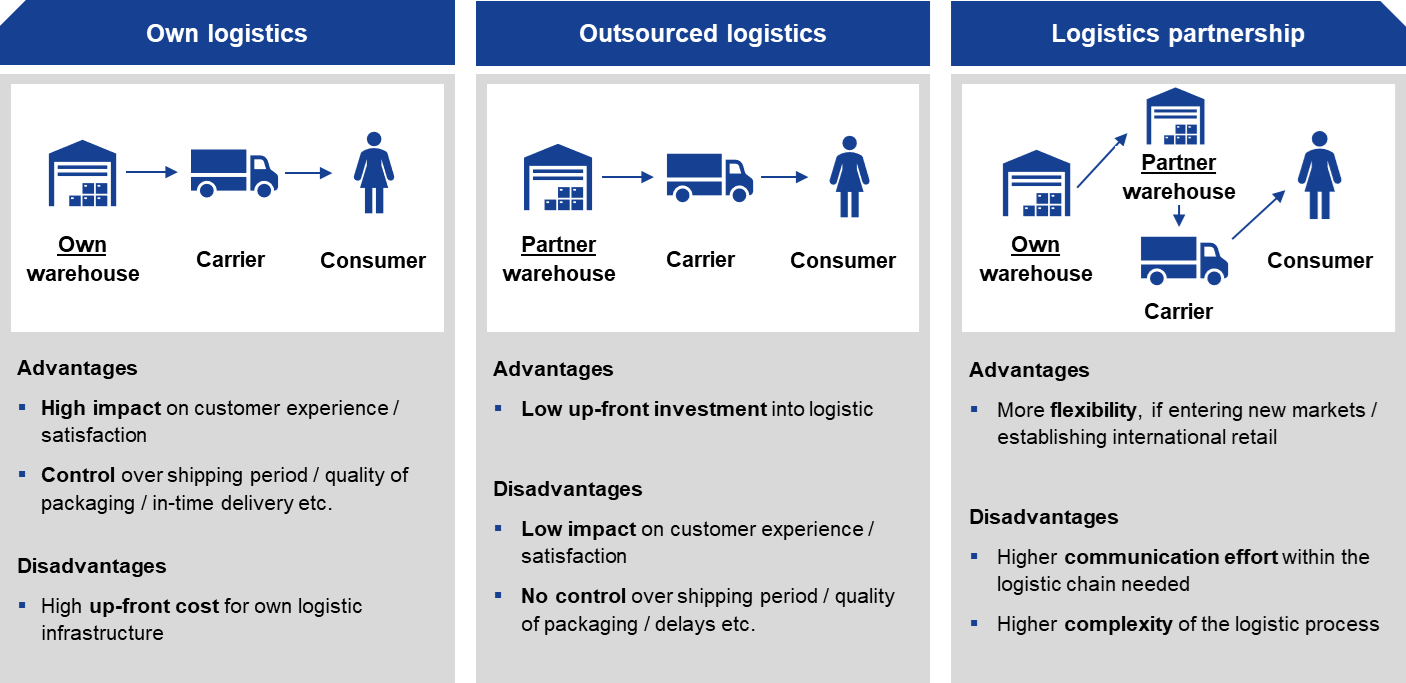

- Development of a logistics strategy: Which logistics options can be considered, and which should be chosen to meet the special needs of direct-to-consumer and to be able to supply customers optimally?

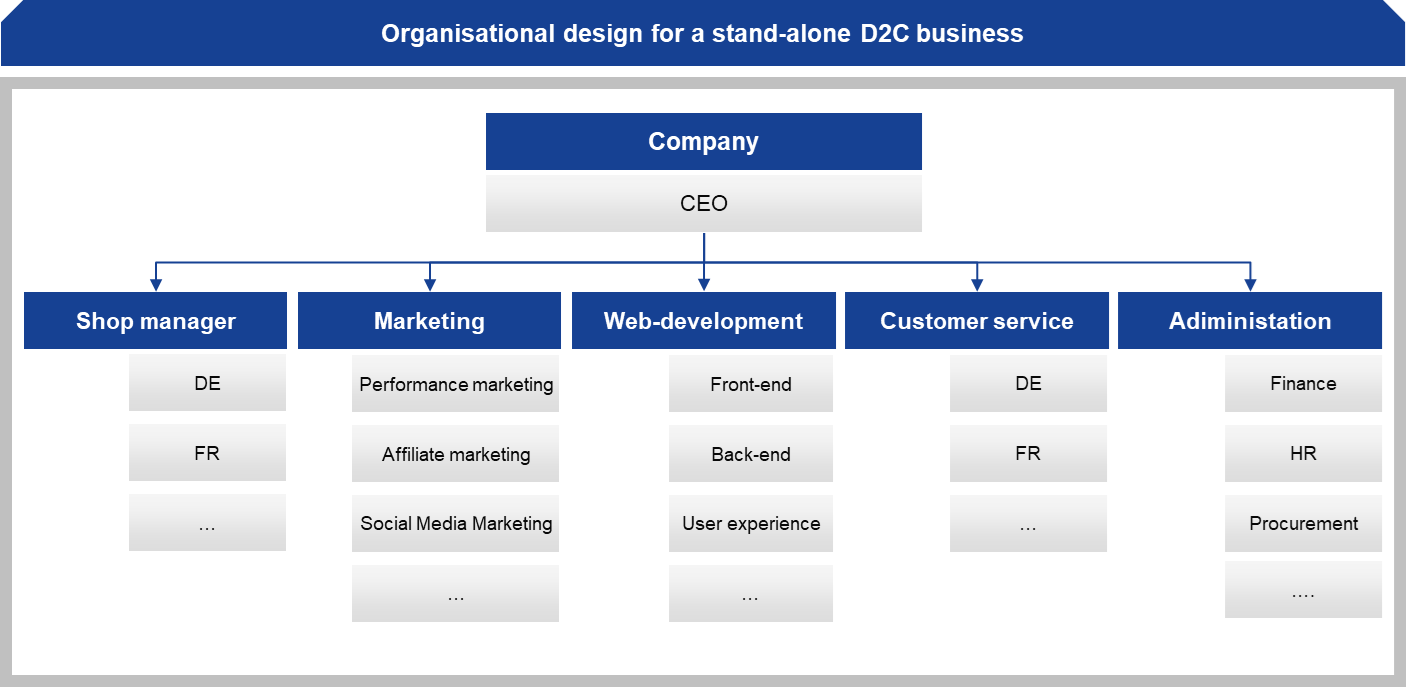

- Organization & Governance Design: How should roles and responsibilities be distributed and created within one’s organization to work efficiently and effectively?

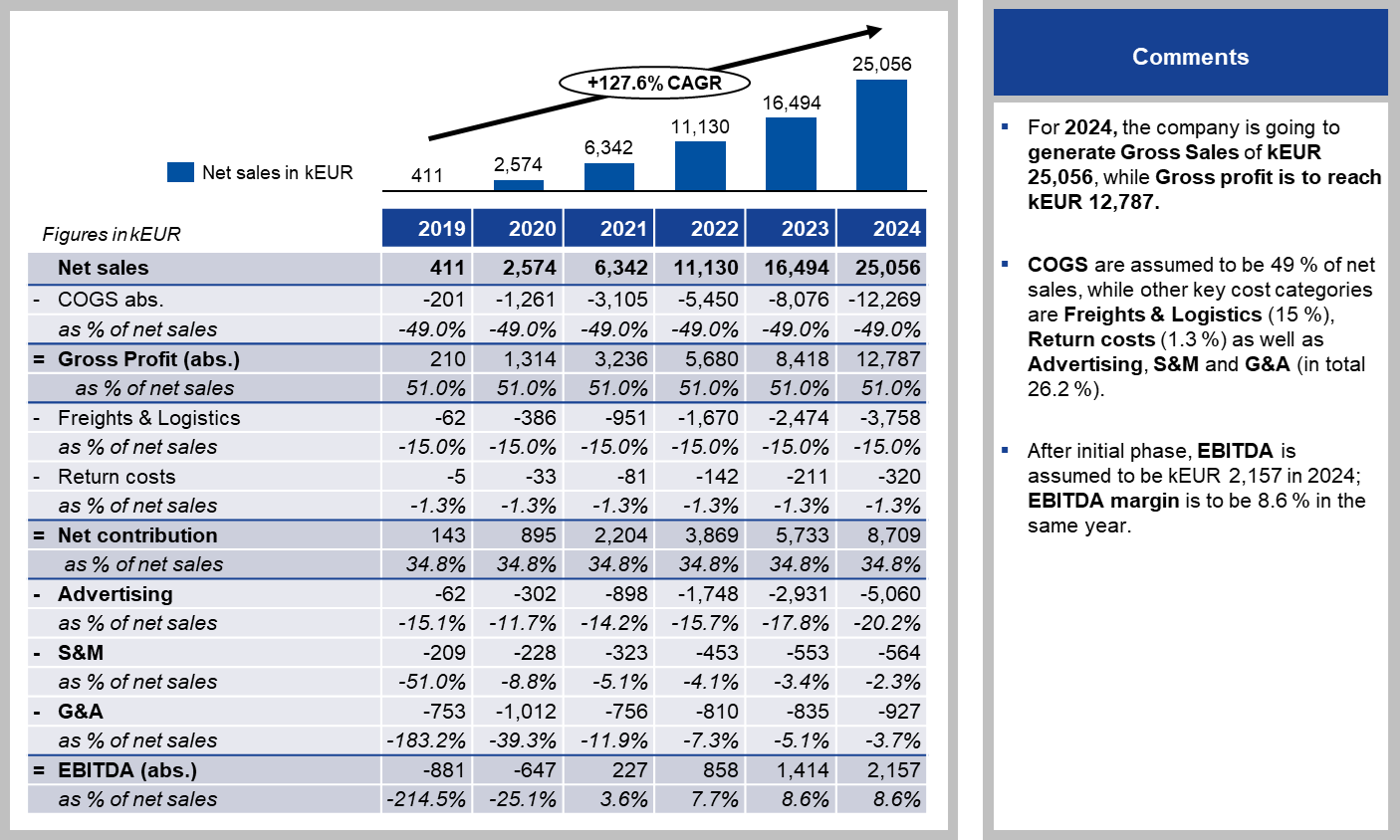

- Business plan based D2C strategy: What are the benefits and costs of building a D2C brand and is it profitable?

Figure 3: Direct-to-consumer (D2C) strategy framework

I. Market potential & trend analysis

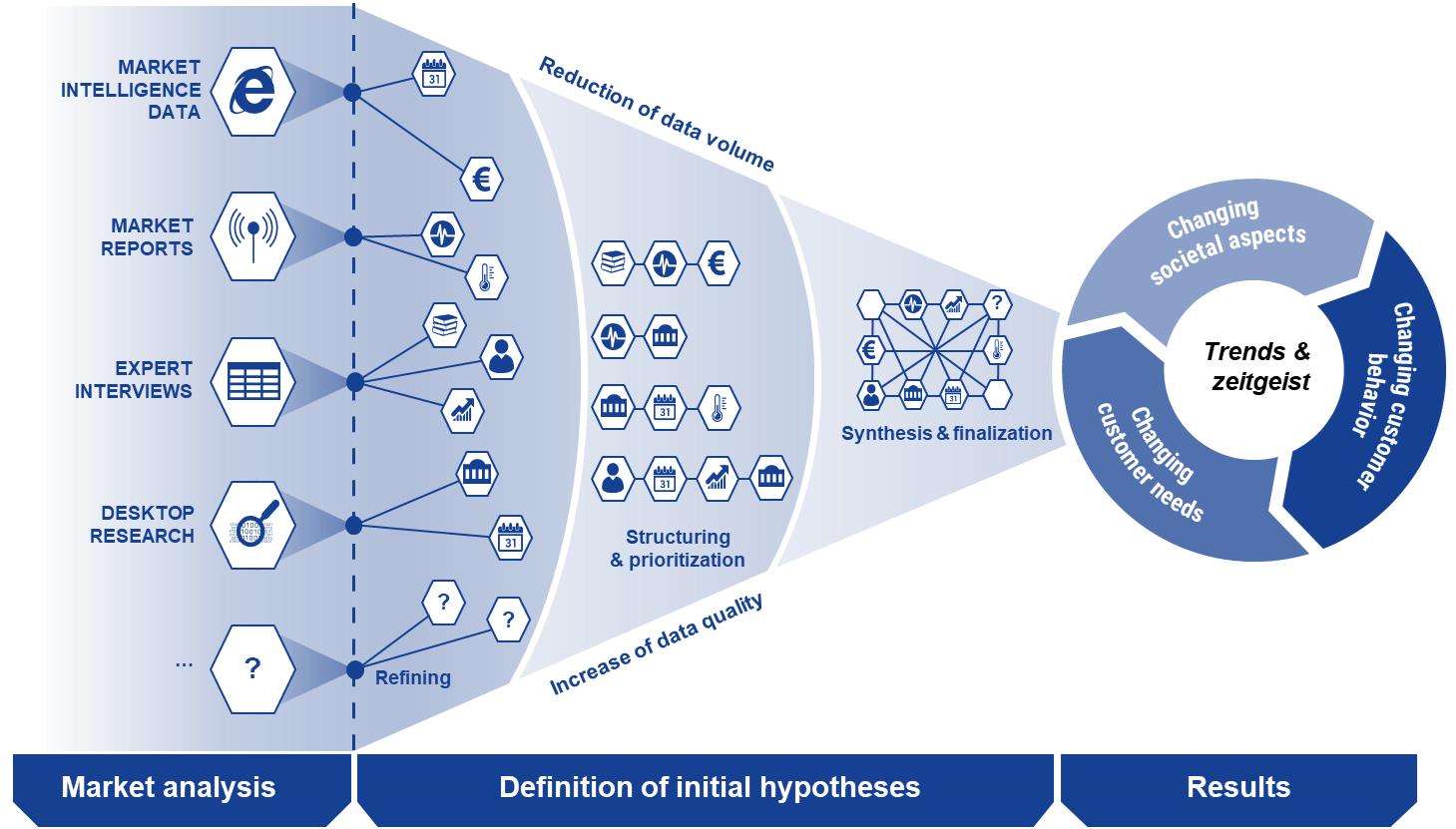

The market potential and trend analysis are the first step in the direct-to-consumer strategy. The determination of the market potential is necessary, as the further development of a strategy only makes sense if the potential is sufficient. Different methods of market intelligence are applied depending on the degree of innovation of the products. An analysis based on data crawling makes it possible to ascertain the turnover and sales potential of the market participants, whereby the total market potential and market shares of individual competitors can be determined. Estimates from the internet search behavior of potential customers are useful, for example, for new products for which there is not yet an established market.

Trend analysis is used to understand societal changes, changing customer behavior, and changing customer needs. The goal is to understand whether the new direct-to-consumer brand being developed is aligned with the needs of customers. Market Intelligence is a continuously relevant topic and is not only important in the preparation of strategic decisions, but above all in the context of continuous performance management. For more information on FOSTEC Market Intelligence, please visit here.

Figure 4: Analysis of market trends and zeitgeist

II. Environment analysis & USP definition

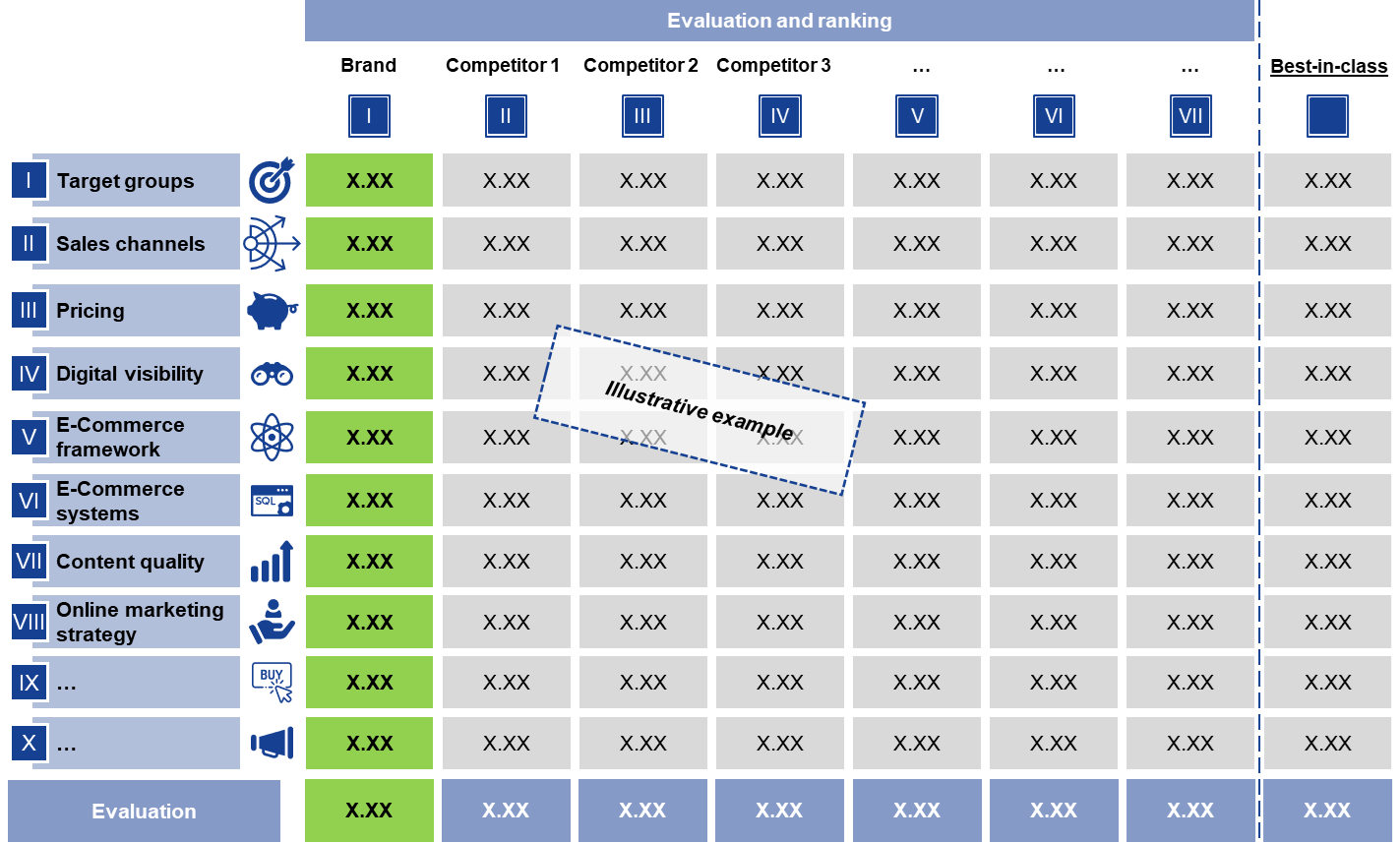

With the help of an environment analysis, competitors are to be compared based on qualitative criteria. The goal is to gain an understanding of the E-Commerce maturity level of direct competitors. This analysis can provide insights into the strengths and weaknesses of competitors and the company’s own brand. In addition, it is analyzed whether customer needs can be met by the company’s offering and whether there is a clear differentiation from competitors. Only if a clear differentiation exists and is perceived by (potential) customers does a unique selling proposition exist that must be continuously developed. If competitors satisfy consumer needs better, this area should be avoided.

Figure 5: Illustrative evaluation model for competition analysis

III. Definition of a technology landscape

Depending on the maturity of the existing technology landscape, the implementation of a direct-to-consumer strategy can bring about strong changes in the IT landscape of a company. A solid IT architecture and system selection are a very high priority for scaling the business. There are three key areas of focus. Instruments for generating inbound traffic must be defined, because a direct sales structure to the end customer bypasses intermediaries in distribution who were interested in actively marketing the products. This task is now the responsibility of the company itself. E-Commerce systems such as shop systems must be implemented and continuously maintained. Due to a higher volume of individual transactions and customer data, supporting systems for operations and reporting are required.

Figure 6: D2C digital technology landscape

IV. Development of a marketing strategy

To achieve sustainable success with a direct-to-consumer strategy, a well-thought-out marketing strategy is required. Marketing channels must be selected that lead to high page views and an attractive conversion rate. Resources must be used efficiently to achieve the highest possible return on investment. Common online marketing tools include search engine advertising and optimization, social media marketing, affiliate marketing, social advertising, and display advertising. Due to the emergence of new market players in E-Commerce and the intensification of competition, online advertising is in high demand and more expensive. This makes continuous performance management of the marketing strategy more important.

Figure 7: Illustrative online marketing strategy

V. Development of a logistics strategy

In contrast to a multi-level distribution structure, the manufacturer is now responsible for the logistics task to the end consumer in a direct-to-consumer strategy. Manufacturers have various options at their disposal. On the one hand, they can set up their own D2C-capable logistics. Products are made ready for shipment to end consumers and delivered with the help of transport service providers. Control and a high impact on the customer experience must be set against the increased investment costs.

Alternatively, end consumer logistics can be outsourced, and products are shipped in bulk to a partner warehouse that handles all logistics to the end customer from then on. This results in lower investment costs, but also eliminates the impact on the customer experience and the control of the shipping process. In addition to a qualitative evaluation of the best possible option, this strategy step also serves to identify suitable logistics partners.

Figure 8: Overview of available logistics options

VI. Organization & governance design

Specific D2C requirements also need to be considered in terms of the organization. This starts with dedicated resources with special know-how, but also includes their cooperation with existing functions within the organization. In addition to the organizational set-up of a D2C management, this must also be equipped with clear role allocations and objectives must be defined. It must be ensured that the overall organization remains as lean as possible, so that a balancing of in- and outsourcing should also take place. Particularly in the context of direct-to-consumer, the area of after sales service must also be established, provided that so far only intermediaries are supplied in the sales structure, who are looked after by (key) account managers.

Figure 9: Organizational design for a stand-alone D2C business

VII. Business plan based D2C strategy

In the final step of the D2C strategy, the profitability of the strategy must be examined. For this purpose, benefits and costs are collected and analyzed transparently by means of a business case. The derivation of sales potential is carried out with the help of market potential estimates. Based on previously defined prerequisites, a corresponding cost structure is estimated. This includes both the operational expenses and the one-off investment costs required to set up the D2C strategy. Both sub-areas, i.e. sales and costs, are combined and evaluated in the sense of an “economic truth”.

Figure 10: Business plan based D2C strategy

Your contact for further questions regarding the direct-to-consumer strategy

Markus Fost, MBA, is an expert in e-commerce, online business models and digital transformation, with broad experience in the fields of strategy, organisation, corporate finance and operational restructuring.

Learn moreMarkus Fost

Download our direct-to-consumer strategy framework paper.

Please provide your name and e-mail address to receive an e-mail with the according PDF file free of charge.