Platform economy – Gamechanger of the 21st century

Disruptive platform business models outperform traditional businesses in many aspects. They create a better customer experience with partnerships and services, offer external worshipers a better experience through network effects, and are increasingly attractive compared to classic one-sided pipeline models.

Pioneering unconventional solutions and covering the entire e-commerce value chain – from logistics to server hosting – Amazon is seen as a showcase example for marketplaces and platform business models of all kinds. Platform economies such as Google, Apple, Facebook, Amazon or Microsoft (GAFAM) have already revolutionized numerous B2C markets in the past and are now increasingly pushing into the B2B market as well. For traditional companies, it is difficult to react to a platform disruption because the entire business model must be redesigned.

The importance of the platform economy is evident from the evolving market capitalization. Whereas in 2006 only one company was represented as a platform company among the most valuable companies in the world in terms of market capitalization, in 2022 this figure will already be six out of ten – and this despite the massive decline in the share prices of many technology companies. Analyses also show that platform business models outperform traditional companies not in terms of company valuation, but also in terms of profitability and growth – and even with a significantly smaller number of employees.

Introduction to the platform economy – The unfair advantage?

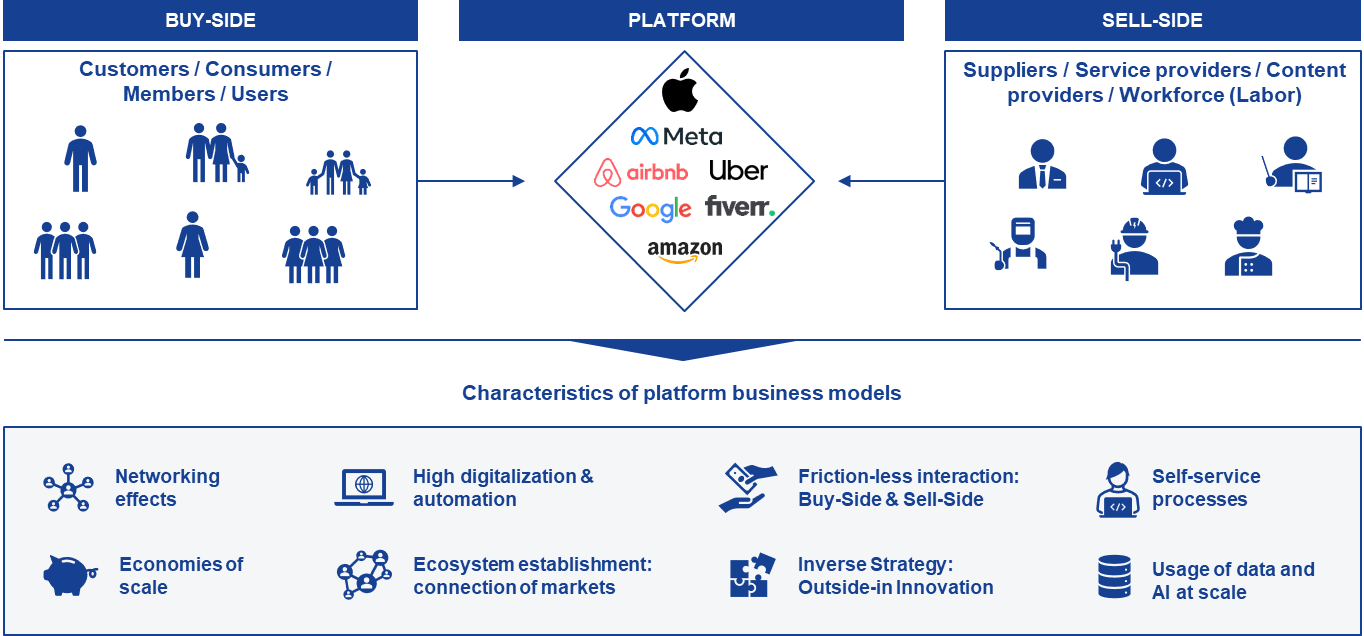

Platforms act as intermediaries between buyers and sellers and provide a technical infrastructure for the exchange or transaction of traded products and services. Extensive services along the value chain can be used to differentiate between different platform types.

Figure 1: Introduction to the platform economy

Digital platforms are characterized by network effects, a high degree of digitization and automation, and economies of scale. Network effects result from the increase in users on the platform. A high number of buyers is attractive for sellers to offer products and services. The increase in the offering by new sellers in turn has a positive effect for new buyers to become active on the platform. In this way, the added value for the entire platform community increases with each new user. The core challenge is to get this process going for the first time.

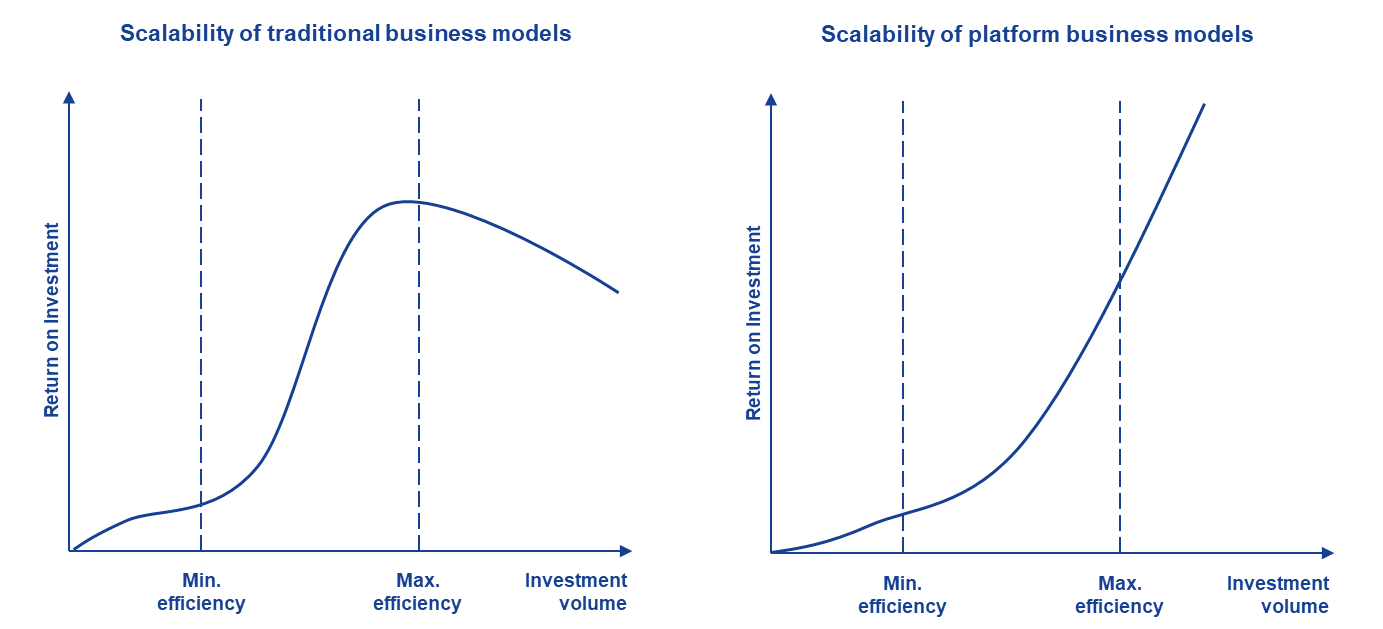

Scalability is another unique selling point of platforms. Traditional business models are limited because scaling reduces the profitability of the business once a certain level is reached. Consequently, most traditional businesses are forced to scale down after a certain point. Internet platforms show almost unlimited potential for scalability without cannibalizing their own profitability. This also increases the long-term revenue growth potential for investors.

Figure 2: Scalability of platforms

Internet platforms have established themselves in almost all sectors of the economy and in many cases offer a central solution from a single source. While retail platforms, platforms in tourism, mobility and comparison portals have been established on the market for a very long time, platforms in the healthcare, insurance and finance segments are still less mature.

Business models in the platform economy

Internet platforms are not just intermediaries between buyers and sellers, but fulfill five different market roles:

- Innovation booster: Digital platforms strive to offer customers tailored products and services. The ambition leads them to generate disruptive business model innovations.

- Generator of customer value: The provision of a maximum product range and the assurance of maximum customer satisfaction mean that digital platforms significantly increase value for customers. High transparency of the market and prices creates fairness for all stakeholders.

- Market developers: Digital platforms develop markets by aggregating supply and demand and keeping market entry barriers for new providers as low as possible. Through platforms, internationalization strategies can be implemented more easily, and optimization of marketing and sales often goes hand in hand with the use of the platforms’ extensive range of services.

- Reduction of transaction costs: By providing a technical infrastructure for suppliers and demand, search and transaction costs are reduced for all parties involved. At the same time, risks in the transaction process are also reduced.

- Guarantor of welfare effects: As intermediaries, platforms also create a basis of trust between providers and demanders. In addition, they reduce market fluctuations and standardize the range of products on offer.

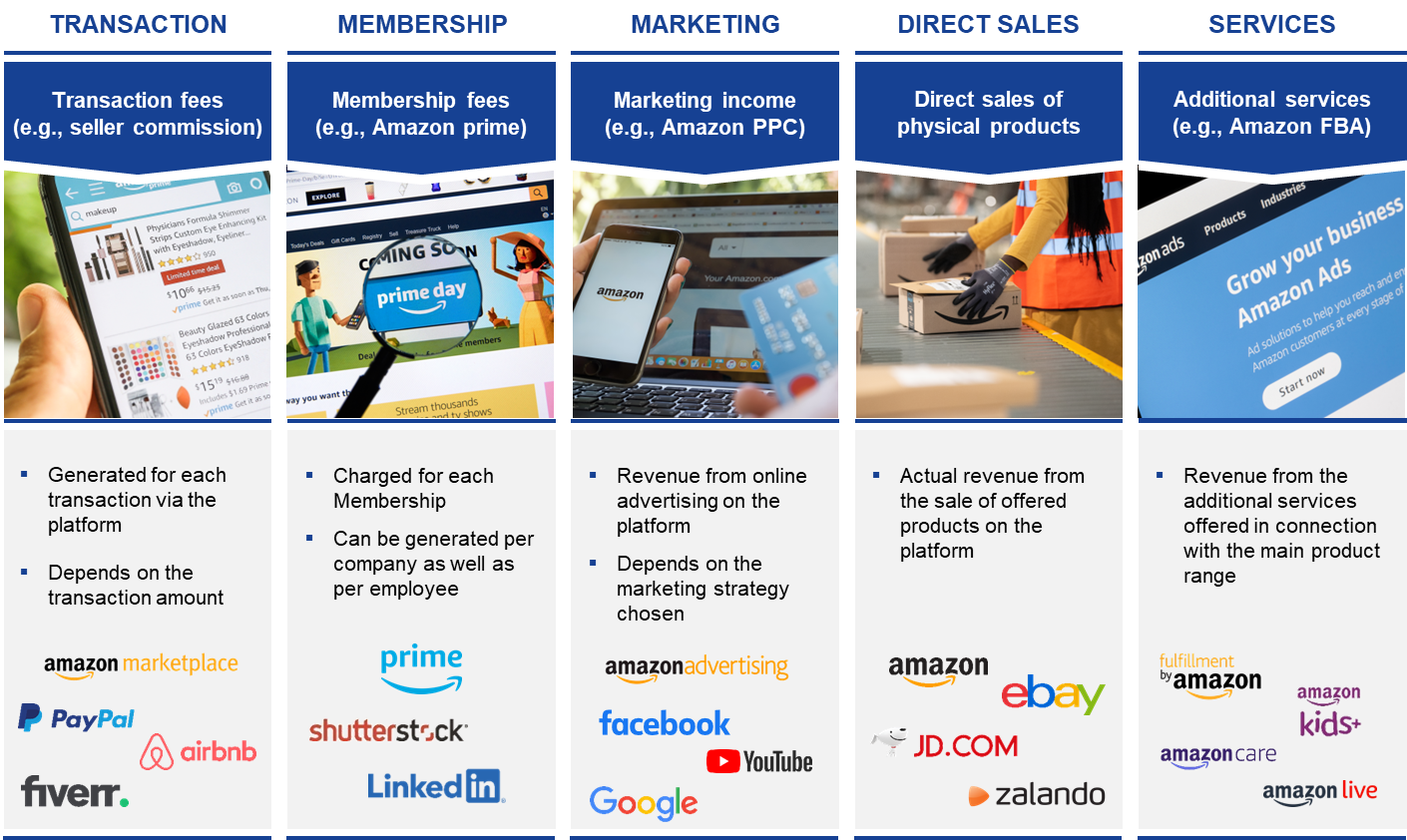

The revenue streams of a platform business are not limited to transaction fees, which is the most common revenue stream. Depending on the business model, membership fees can be charged. Amazon Prime is an example of this, giving Prime customers access to exclusive services. Attractive for platforms with a high number of users are revenues from marketing. Amazon Advertising, for example, has established itself as a major revenue generator for the Amazon Group. Even though platforms are known for being a link between suppliers and demanders, they can also act as product sellers themselves. Finally, platforms can generate by offering different services along the value chain. For example, Amazon offers to take over fulfillment for marketplace sellers for a fee.

Figure 3: Revenue sources with platform business models

Development of the platform economy

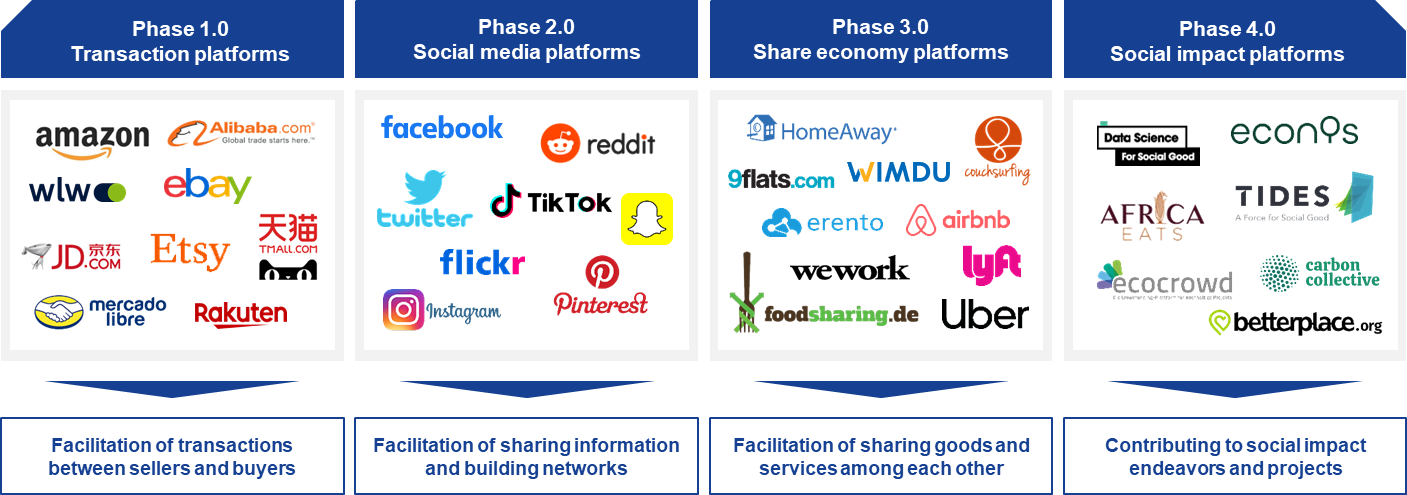

Even though online marketplaces such as Amazon or eBay are prominent examples of the platform economy, the development of the platform economy shows that a new phase always has a specific objective.

The origins of the platform economy can be traced back to transaction platforms, also known as two-sided markets or multi-sided markets, which are designed to facilitate the buying and selling process. Buyers gain access to a wide variety of products offered by sellers. While generalist marketplaces cover a wide range of product categories, specialized marketplaces cover niches. The second phase is founded by social media platforms. These facilitate the exchange of information, ideas and thoughts by connecting to virtual networks. Social media has changed the way we interact, communicate and how we are influenced by the opinions of others. Businesses use social media to spread their stories and attract new customers, often with the support of influencers.

With the emergence of share economy platforms, platforms have emerged that are asset-light or asset-free and have driven traditional providers out of the market through highly disruptive business models. Such platforms are essentially based on the philosophy of users that everything can be shared such as means of mobility, housing, workspace and even food. Social impact platforms – as a current phenomenon of platforms – aim to achieve social impact goals with the support of a large audience. Social impact platforms do not have the goal of maximizing profits but want to overcome challenges of the current time together with a large community. Well-known examples are investment platforms for renewable energies and data sharing.

Figure 4: Development of the platform economy

Conception of business models of the platform economy

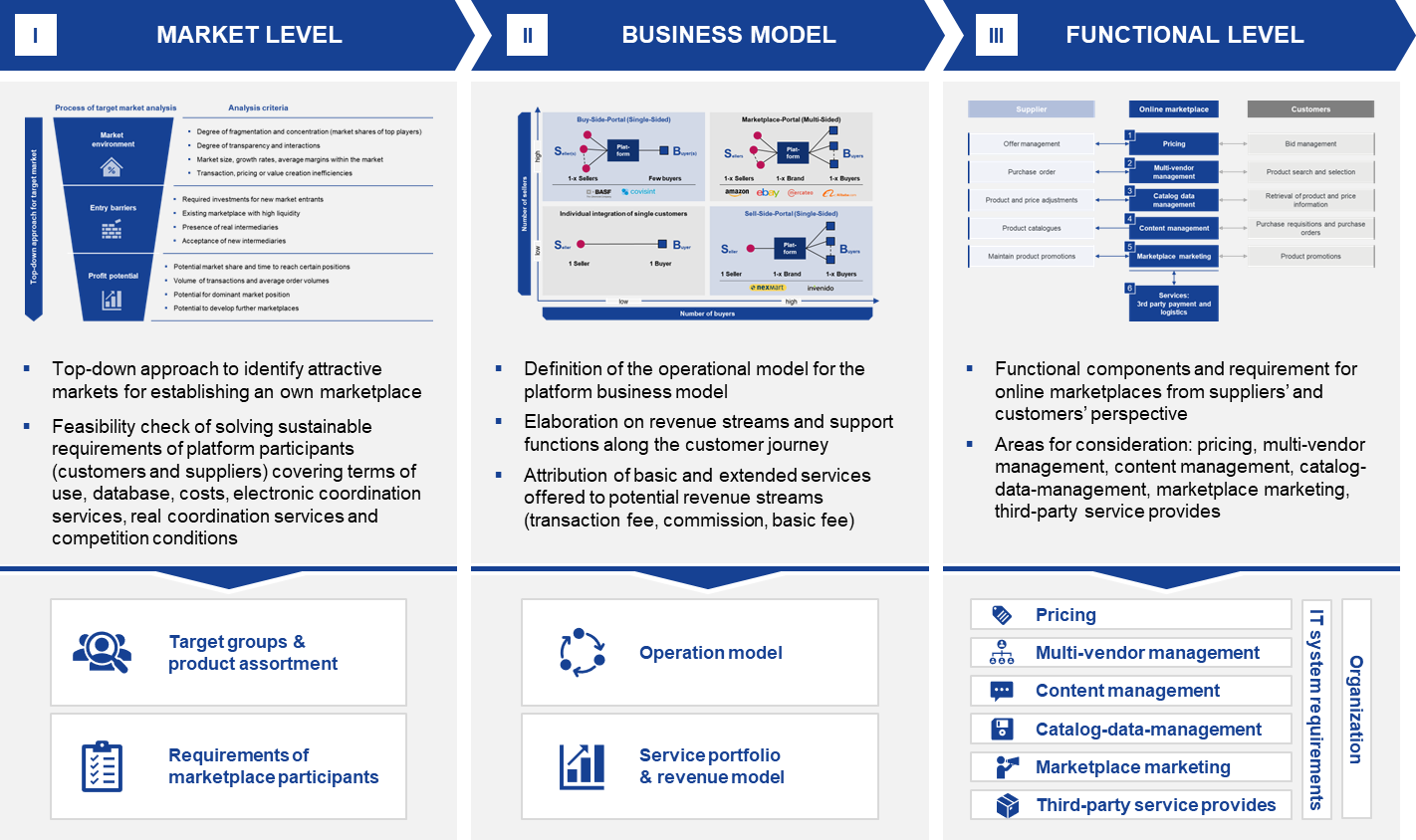

For the development of a platform business model, an attractive market for the development of a marketplace must first be identified, as well as the feasibility of implementation within the market segment. The second step is to define the operational business model with revenue streams for services offered and support functions along the customer journey. Finally, the concrete functional components are determined from the requirements for suppliers and customers. These include the type of pricing, multi-vendor management, content management, catalog data management, marketplace marketing and the integration of third-party service providers.

Figure 5: Conception of business models of the platform economy

I. Market level: Target groups & product/service offering – Requirements of platform players

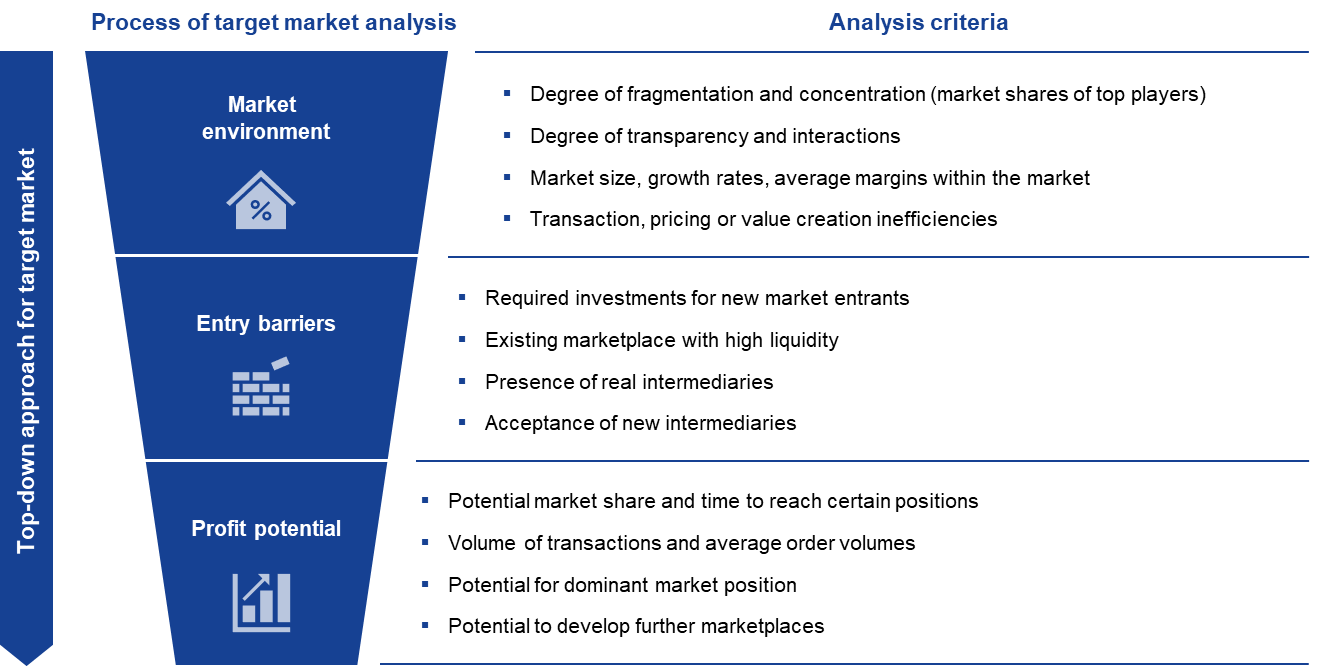

A successful platform business model requires an attractive market segment for its development. This can be derived using a top-down approach. The first step is to analyze the structure of a market segment in terms of fragmentation and concentration. The aim is to find out whether there are inefficiencies in transactions, pricing and the value chain that can be reduced by using a platform business model. These factors are important prerequisites in addition to an attractive market size and positive growth prospects.

Entry barriers and required investments for new market participants as well as the existence of existing marketplaces are also examined. To determine a profit potential, it is necessary to estimate how large the transaction volume that can be converted is and what market share the company’s own platform can take. Nevertheless, it must always be borne in mind that other market participants can also enter the market and will gain market share.

Figure 6: Target market for own marketplace

II. Business model: Definition of the operating model – Service portfolio and revenue structure

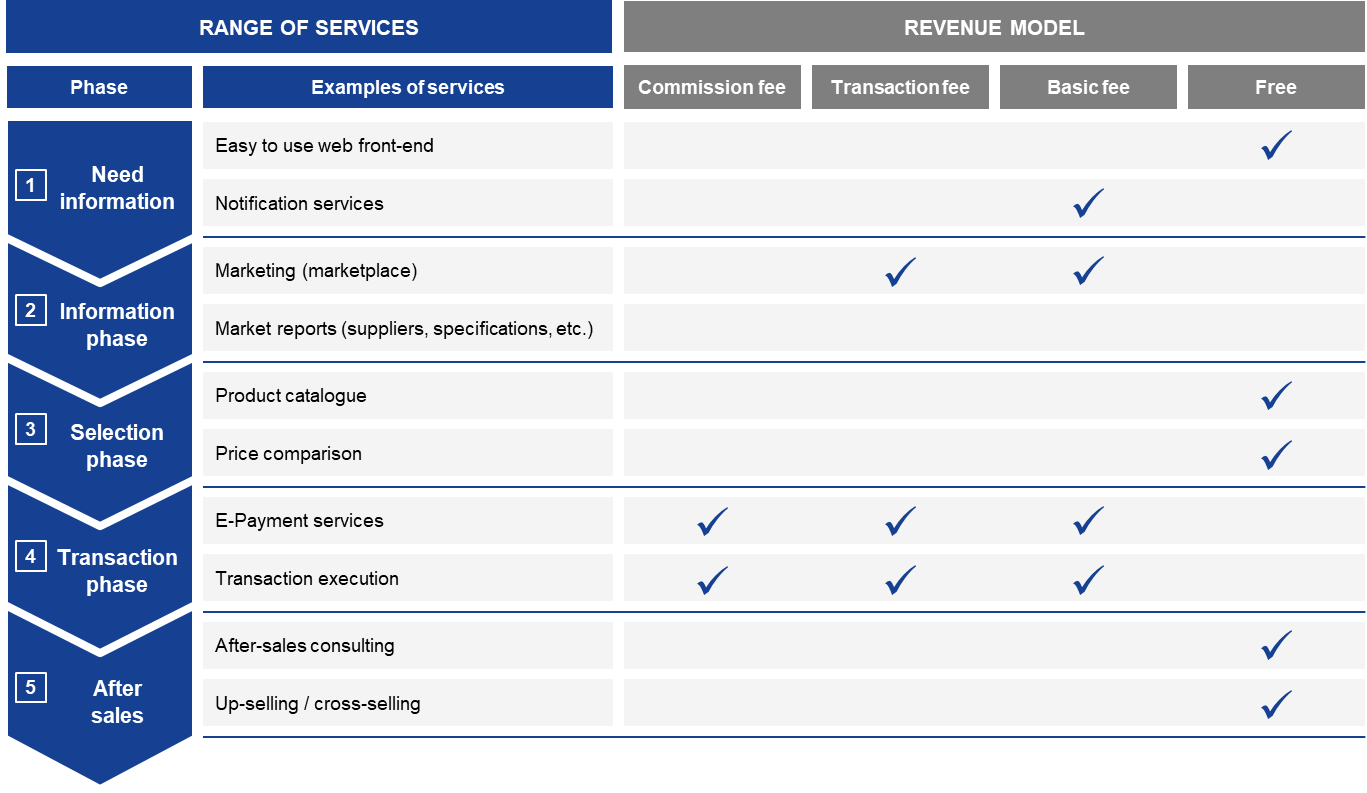

Once the decision on a market segment has been made, the next step is to define the operational business model, the services offered, and the associated revenue sources. The digital services offered are defined along the customer journey. A distinction is made between two types of services. Services that generate revenue or are potential revenue drivers are classified as revenue streams. Supporting functions (support functions) are unpaid elements that support (potential) customers in their activities within a portal, facilitate purchasing processes, and promote log-in effects.

Figure 7: Service offering and revenue model (illustrative)

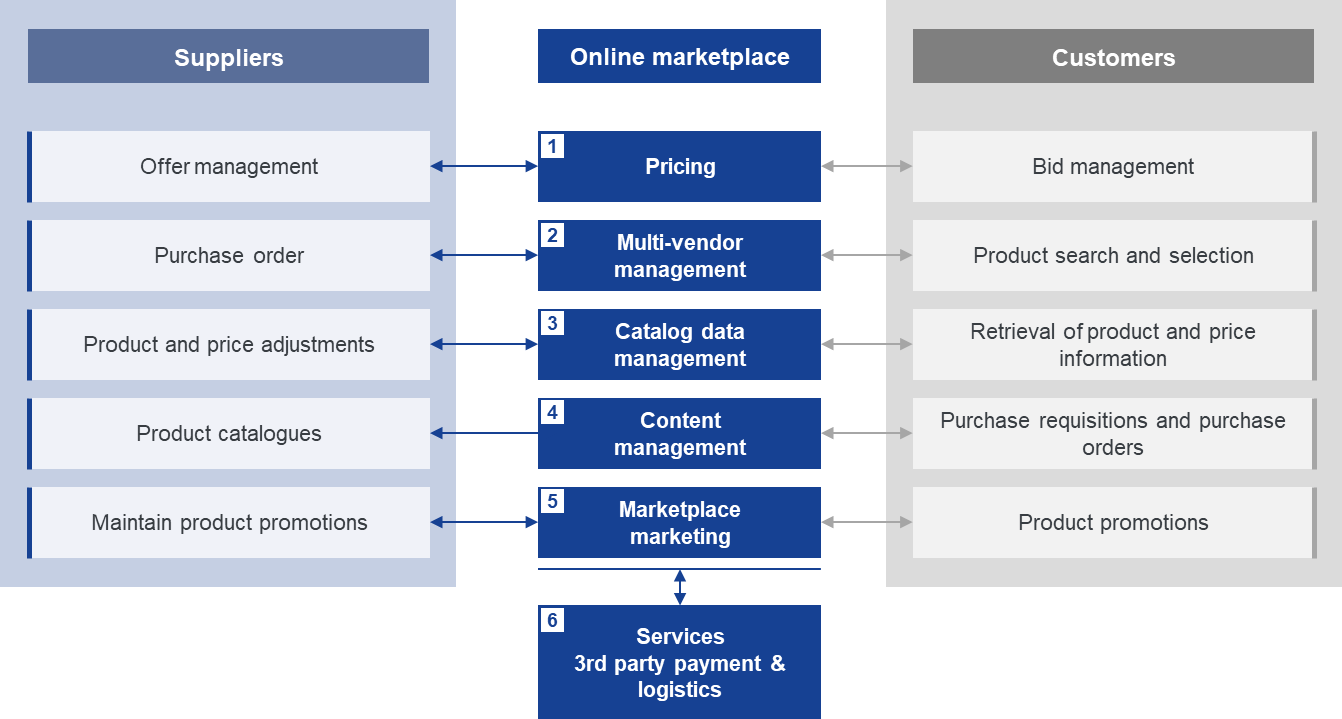

III. Functional level: Functional components and requirements for online marketplaces

Once all services have been defined, the focus is on functional requirements. For suppliers and customers, this includes pricing, multi-vendor management, catalog data management, content management, marketplace marketing, and third-party service provider integration.

In the context of pricing, it must be ensured that suppliers can set prices for their listings and customers can bid on them. In the B2B context, it must also be possible to offer tiered pricing. Since similar products can be sold by different vendors, the online marketplace must operate multi-vendor management. Customers need search functions to find the right product and vendor. Content management includes the product catalogs, where the product data provided by suppliers is collected and displayed on the product detail pages. Customers can then obtain information using all the product content offered.

Given the large number of products, suppliers need to be able to promote their products and brand businesses. This is made possible by marketplace marketing. Likewise, customers are entitled to see the special offers to consider making a purchase. Added value is also created by third-party providers offering complementary services. Of great importance here are payment providers and logistics service providers.

Figure 8: Functional requirements for online marketplaces

Your contact for questions regarding the platform economy strategy

Markus Fost, MBA, is an expert in e-commerce, online business models and digital transformation, with broad experience in the fields of strategy, organisation, corporate finance and operational restructuring.

Learn moreMarkus Fost

Download our platform economy strategy framework paper.

Please provide your name and e-mail address to receive an e-mail with the according PDF file free of charge.