Overview - FOSTEC Market Intelligence

Full market transparency in e-commerce with FOSTEC Market Intelligence

FOSTEC & Company is the leading independent strategy consulting boutique with a focus on digitalisation and e-commerce.

Having already conducted numerous Amazon potential analyses for brands from various industries, we are a market leader in the Amazon consulting sector in Europe. We think and act based on entrepreneurial values and develop intelligent, actionable solutions with our clients to help them unleash their full Amazon market potential.

Simply put, market intelligence is about the gathering, analysis and preparation of information for business-related strategic decisions about the market, competition and customers. Through systematic, lawful (EU-compliant) data collection – for example, from leading online marketplace Amazon – the following five core indicators can be ascertained and, where necessary, analysed on an up-to-the minute and product-specific level:

- Market potential (e.g. certain product categories)

- Competitors Market shares (e.g. of brands on Amazon)

- Competitor Top-Seller (e.g. by turnover & sales)

- Competitor prices (e.g. certain articles over time)

- Assortment performance (e.g. best seller, sales, etc.)

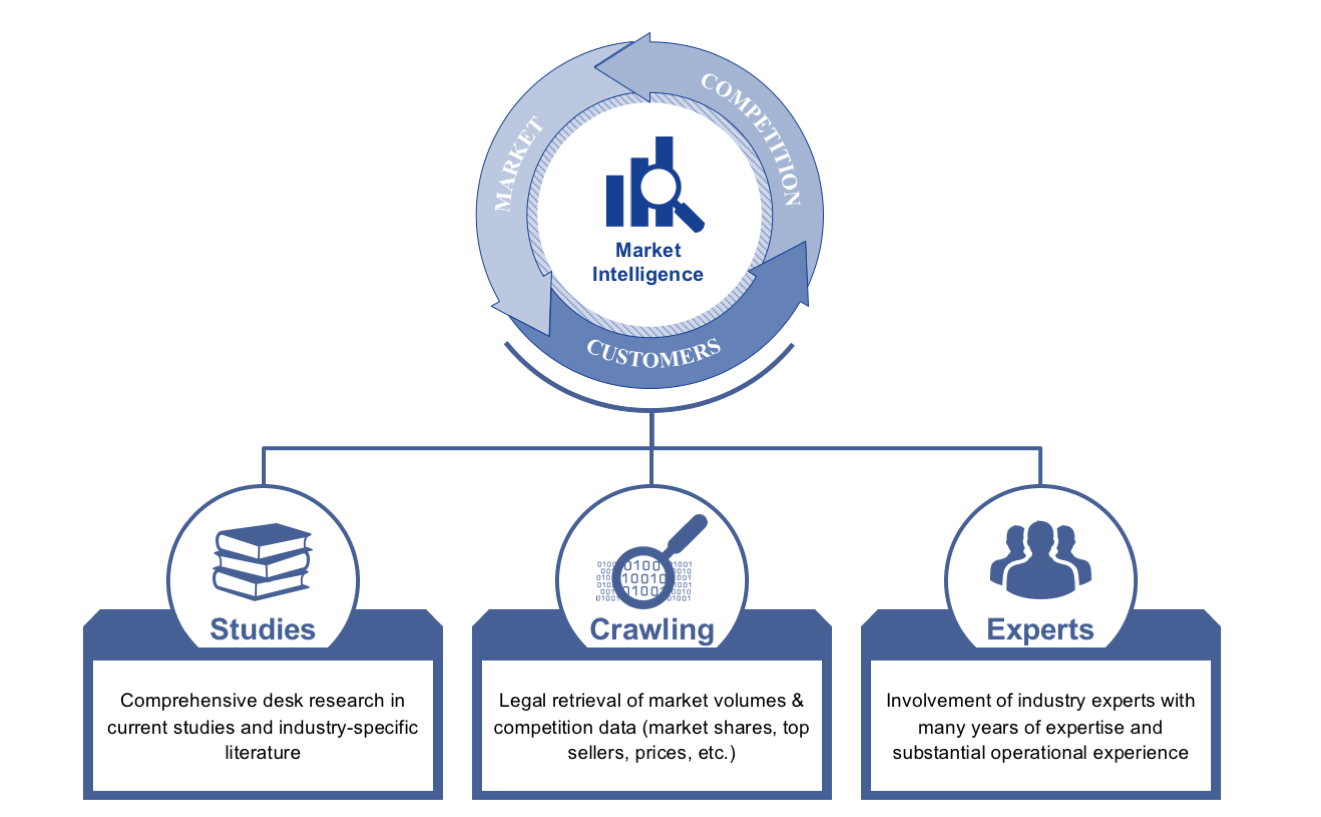

Essentially, the data basis for market intelligence is based on the following three pillars:

Key data pillars for market intelligence

Market intelligence as part of strategy & performance management

When looking at things from a process perspective, the subject of market intelligence usually represents a first step – in the development of an e-commerce strategy, for example. The reason for this is that a fact-based foundation is required right from the outset to enable a brand to evaluate the existing market potential and identify the most attractive segments. Only in the case of sufficient potential should the development of a corresponding strategy even be pursued. However, market intelligence also has a great deal of ongoing relevance. The ability to call up real-time data enables the analysis of up-to-the-minute competitor intelligence data such as market shares or campaign results. Accordingly, marketing intelligence is essential not only in the preparation of strategic decisions, but also in the context of continuous performance management.

Overview of the central advantages of data-driven analysis

The main advantages of an analysis based on crawling data are:

- Meaningful business planning through tailored choice of categories

- Typically, both top-down and bottom-up business planning are based on general market studies, which are only roughly indicative of the product categories that are truly relevant for a particular company. This dilution with irrelevant market data results in huge uncertainties early on in the process. The advantage of crawling data-based analyses lies in the fact that the analysis is tailor-made and that only relevant data will be obtained, thus avoiding uncertainties of this nature.

- Meaningful data basis for up-to-the minute evaluation at a product level

- Crawling data is based on daily tracking of transactions at an product level. This detailed data is then aggregated at a higher level, e.g. for product categories or brands. As such, it is possible both to carry out evaluations at the product level and to obtain an overall snapshot.

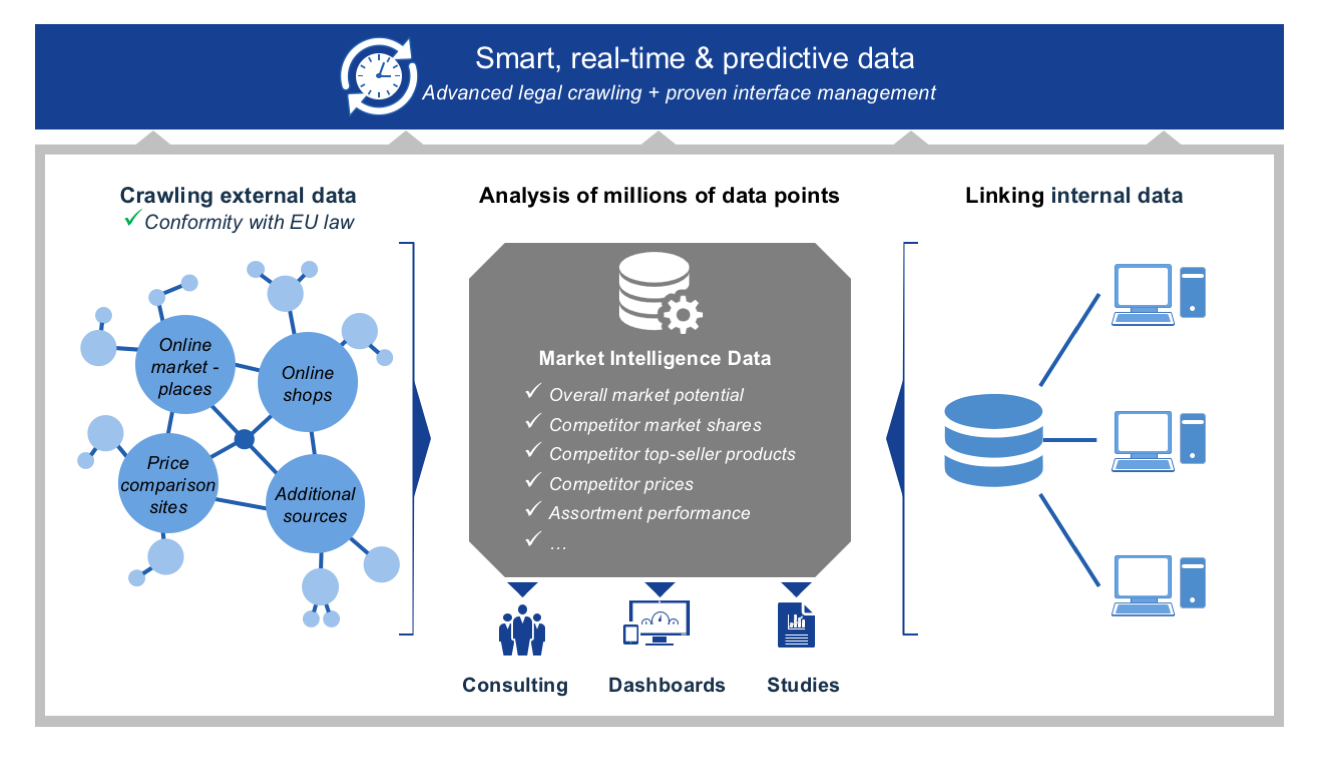

Methodology - Data Generation and Output

As can be seen on the left side of the following illustration, market and competition data is collected out from various data sources including online marketplaces, online shops or price comparison sites. An algorithm-based crawl system accesses the various sources. It is possible, for example, to implement daily tracking of transactions at the item level on Amazon.

Data collection methodology in brief

The detailed data obtained via crawling is then aggregated at a higher level, e.g. product category or brand. Accordingly, it is possible both to carry out evaluations at the detailed level and to obtain an overall overview. An organisation is able not only to access their own data, but also that of all competitors listed in the respective source. This enables the determination of exact market shares.

An additional link to internal data (see the right-hand part of the illustration above) further refines the data, resulting in a comprehensive and transparent picture of e-commerce potential and attractive product segments.

Market Potential (Specific Product Categories, Etc.)

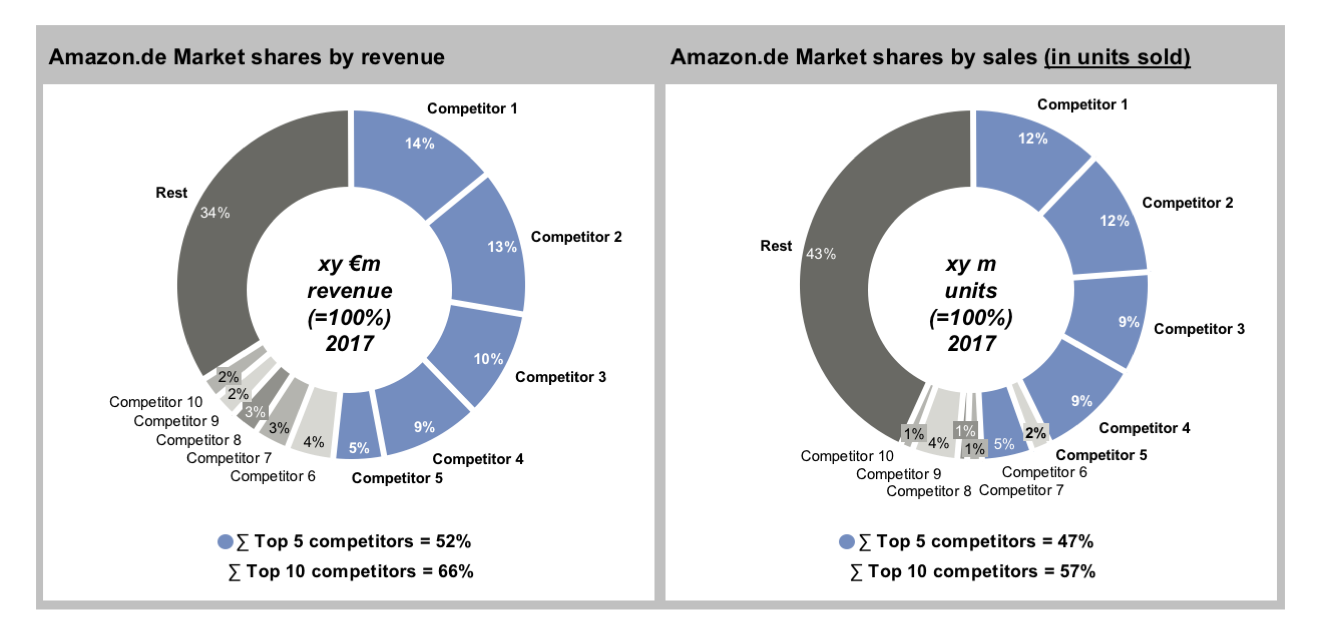

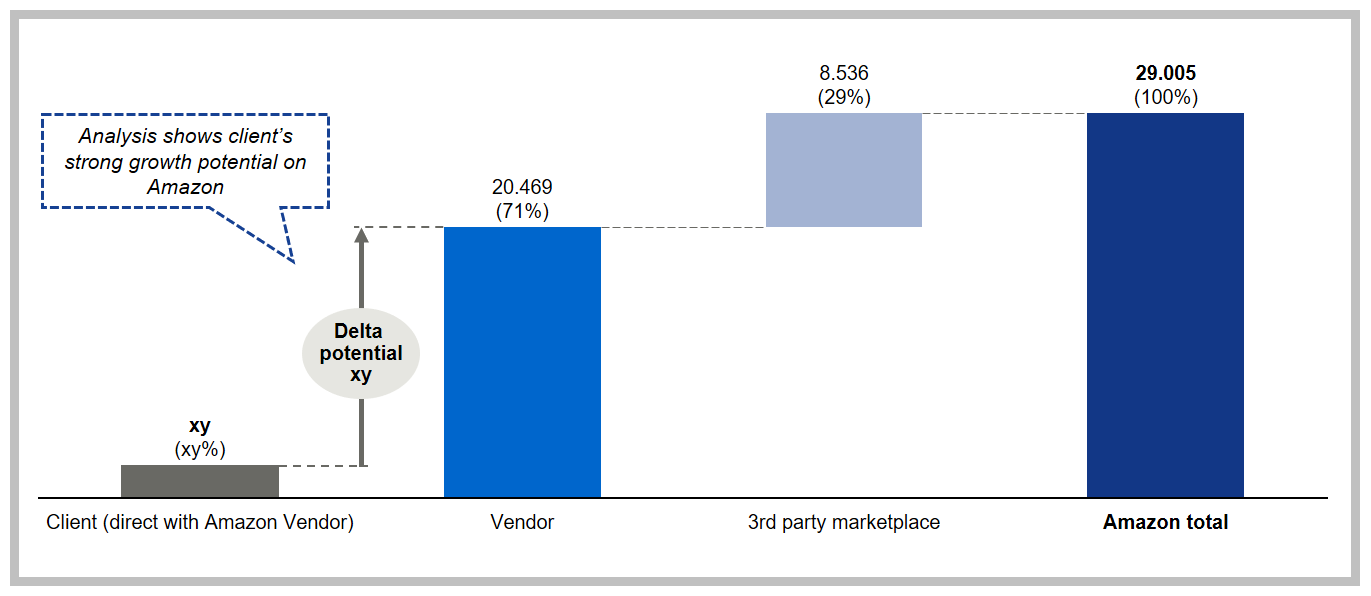

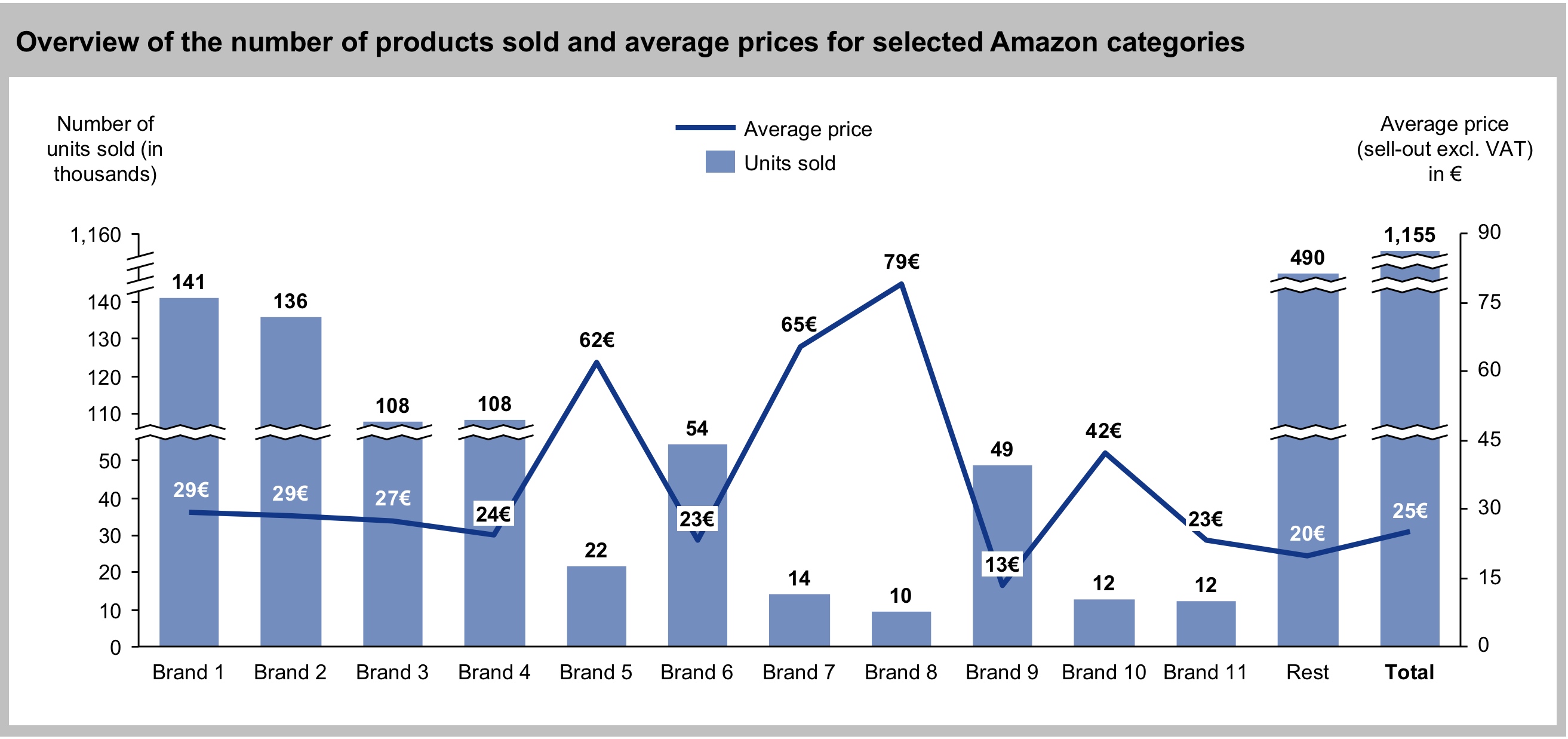

The determination of overall market potential is a pivotal input for fact-based business case. Using methods such as data crawling, the overall potential of selected product categories on Amazon – based both on revenue and items sold – can be determined precisely and with a high degree of certainty. Thanks to this market transparency, it is easy for vendors to effectively evaluate the actual level of market attractiveness.

The following example shows the overall potential differentiated by vendor and marketplace sales as well as by the market share of a selected brand.

Overall market potential of selected Amazon categories

Competitors' Top Sellers (By Sales Revenue, Sales Volume and More)

Crawling data enables up-to-the-minute evaluations at product level. Accordingly, it also allows us to determine the top-selling products amongst all competitors in particular categories, which in turn provides important information about main drivers of a top ranking. In light of the fact that the distribution of sales by ranking is anything but linear, this is a crucial area of investigation. At Amazon, for example, depending on the category, up to 90% of revenue might be accounted for by the top ten-selling products, which makes clear the necessity of systematically pursuing a high ranking. Furthermore, the database of top sellers is an important starting point for further value-adding analyses.

Advantages of a top seller analysis

- Identifying product line gaps: By comparing the provider’s product line with top sellers, we can examine the extent to which gaps in the product line need to be filled.

- Inspiration for product development: By evaluating customer reviews, we can find out which product features customers really like as well as the extent to which features are missing and further development is needed.

- Findings for sales & marketing: By analysing pricing and customer evaluations, we can ascertain the customer’s willingness to pay, enabling the right conclusions to be drawn for pricing and marketing strategy

- Possible areas of action for listings optimisation: An analysis of the quality of individual product listings with regard to media content, HTML content with product descriptions, etc. provides information on possible areas of action in this regard.

Competitors' Prices (e.g. for Particular Articles Over a Period of Time)

The collection of data through crawling delivers up-to-the-minute prices at the item level. This means that over a certain period of observation, a very accurate picture of competitor prices and associated pricing strategies can be obtained. Central insights can then be derived for the creation of a brand’s own dedicated pricing strategy.

Sample price analysis

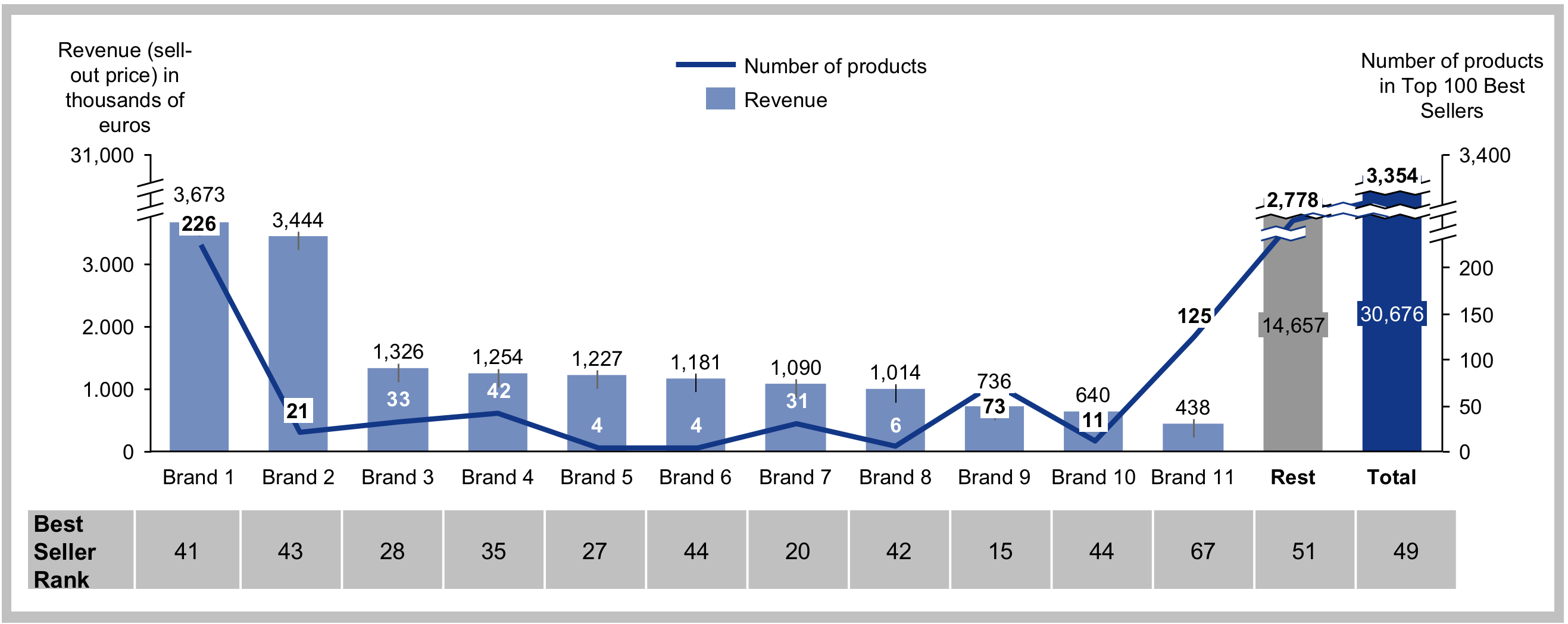

Product Line Performance (Best Seller Rankings, Revenue and More)

The market data collected allows meaningful conclusions to be drawn about the performance of the current product line, e.g. in terms of average sales per product listing. Appropriate optimisation measures for the vendor’s product portfolio can then be derived on the basis of these performance indicators – above all on the basis of comparison with the competition.

Sample product line performance assessment

In general terms, the desired market transparency can be achieved within the framework of a (one-off) study or, alternatively, on a continuous basis, through the installation of a dedicated performance cockpit or dashboard. This can also be linked to internal controlling data via corresponding interfaces, thus offering regular transparent updates on product line performance.

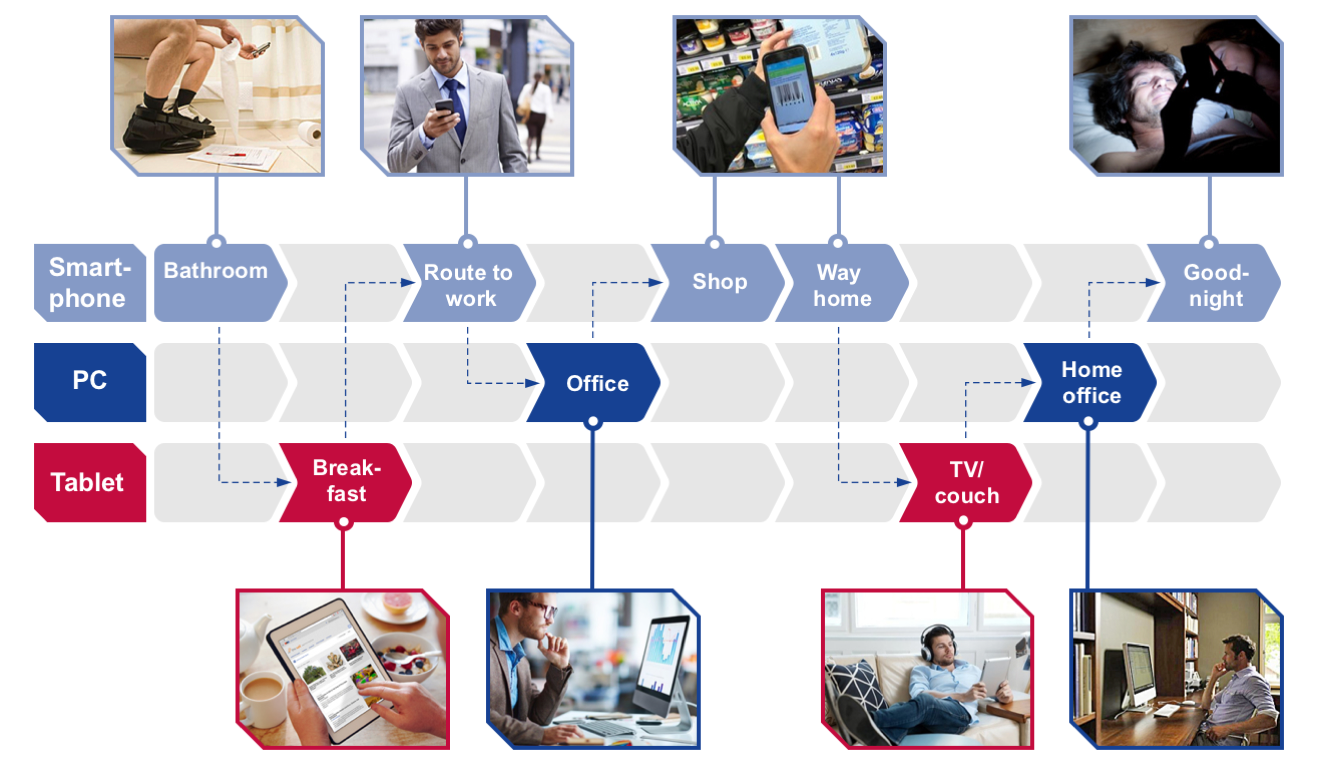

Digital lifestyles are fundamentally changing consumer behaviour

Customer Journey Analysis - Fully understand the customer's purchasing journey

Thanks to the ever-increasing onslaught of new technologies, the use of mobile devices is growing rapidly amongst both private and business customers. The resulting “digital” habits have effected fundamental changes to consumer behaviour. The schematic diagram below illustrates what typical media/device usage looks like over the course of a day. Different devices are used depending on the time and situation.

Example of media/device usage over the course of a day

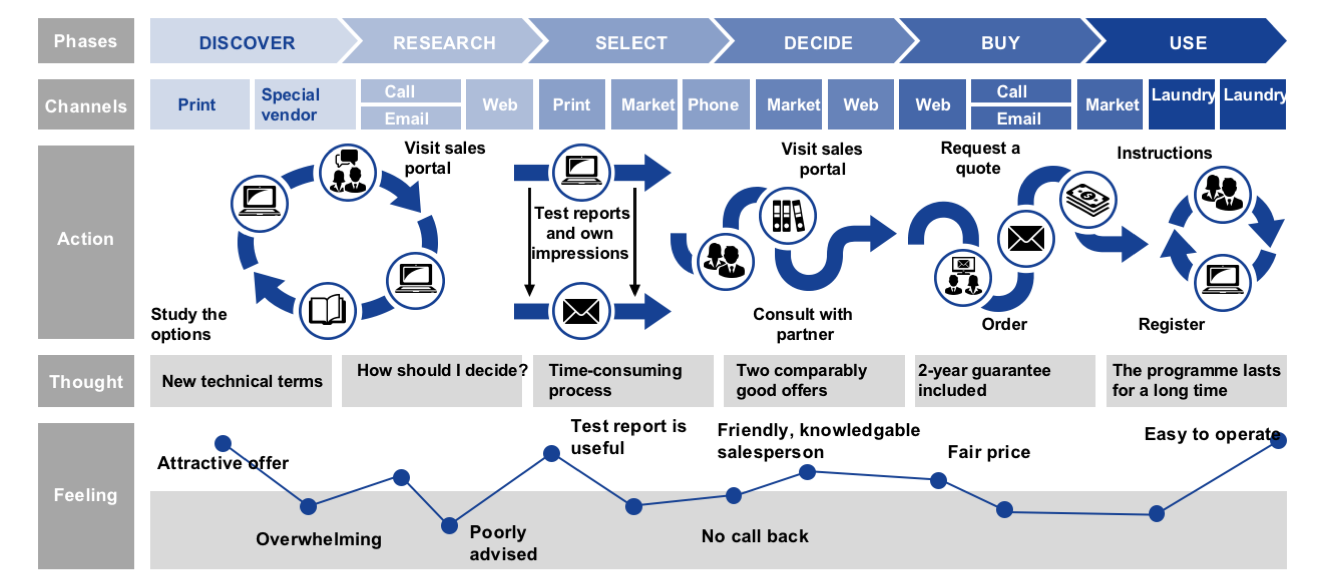

To address B2C and B2B customers correctly – that is, in accordance with the changes in their consumer behaviour – it is vital to understand the customer journey. E-commerce providers must therefore develop a detailed understanding of relevant contact points for a particular customer group, from the origin of requirements all the way through to after-sales. It is only when the customer’s journey is really known and understood that appropriate measures can be derived for addressing them in a more targeted fashion. Furthermore, it is also necessary to address customers differently during different phases of the journey. Ultimately,what is required is a holistic concept that supports customers through the different phases of the journey and thus across the various communication channels. This is the only way to ensure positive stimuli for consumers’ thoughts and feelings (see Figure 2) and to systematically increase the likelihood of a purchase. The figure below shows a possible customer journey for a washing machine, demonstrating its complexity with regard to channel changes and customer thoughts and feelings.

Sample customer journey for the purchase of a washing machine

The approach to creating a customer journey is as follows:

- FORMULATING QUESTIONS

- How do customers behave throughout the buying process, by whom are purchasing decisions made, and what implications does this have for marketing and online brand presence?

- Achievement of a sufficient understanding of purchasing behaviour among customers in various target groups

- METHOD

- Empirical field research, expert survey

- 30-minute telephone survey using a fully structured questionnaire with open and closed questions

- SETTING GOALS

- Identification and assessment of relevant channels with regard to their relevance over all five phases of the customer journey

- Expansion of knowledge about the use and relevance of touchpoints in the individual phases of the buying process; creation of a differentiated target group analysis

- BENEFITS

- Better and more targeted control, planning and implementation of marketing, sales and e-commerce strategies; more efficient budget planning

- Targeted and efficient handling of target groups throughout the buying process through sales and marketing

However, our understanding of the “customer” and the relevant contact points on the customer journey must still be further differentiated; that is, a better understanding of the “customer” or the “customer groups” must be achieved. In e-commerce, such “typecasting” of customer groups takes place by means of personas. Personas represent a typical customer group with specific characteristics (sociodemographic characteristics such as age, education, etc.) and usage behaviour (web habits, user behaviour, etc.). The result is a comprehensive picture of the target group that enables us to address them in a targeted manner – that is, a manner tailored to their individual needs.

Download

Download our Market Intelligence Overview with selected case studies.

Please provide your name and email address to receive an email with the corresponding PDF file free of charge.